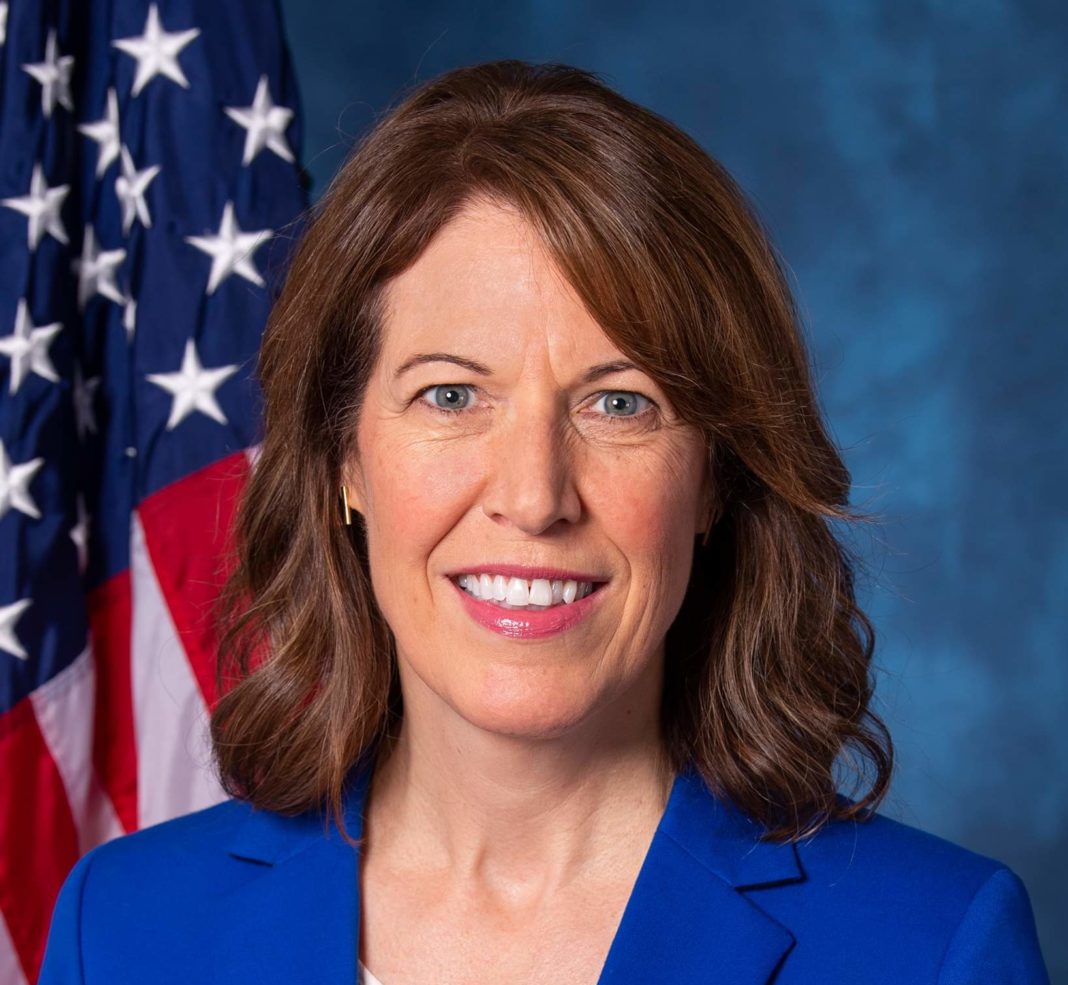

As the December round of tax cuts from the expanded Child Tax Credit begin to reach Iowa families, Rep. Cindy Axne (IA-03) is highlighting a new report that estimates her vote will have delivered nearly $1 billion in tax cuts to Iowa’s families by the end of the year.

The report written by the Joint Economic Committee, a bipartisan bicameral committee in Congress split evenly between Republicans and Democrats, estimates that $946.4 million in tax cuts will be distributed to more than 340,000 Iowa families between July and December 2021. Last month, Child Tax Credit payments went to parents of 624,000 Iowa children.

“Not only is this nearly a billion dollars in tax cuts for Iowa families, who are using this extra money in their pocket to cover their expenses, raise their children, and afford a middle class life. This is nearly a billion dollars going back into Iowa’s small businesses and local economies,” said Rep. Axne. “This is only a half year of those benefits — but I’m committed to making sure this is just the beginning. Just imagine the impact that even one more full year of this benefit could have on Iowa’s middle class families and our economy. That’s why I voted last month to extend this benefit through the end of next year, and I continue to urge my colleagues in the Senate to pass our Build Back Better Act as soon as possible to ensure these tax cuts continue to reach Iowa.”

A previous JEC report also estimated the Child Tax Credit is putting $19.3 billion into local economies across the U.S. each month, supporting local jobs and businesses.

Last month, Rep. Axne voted to extend the monthly payments of the expanded Child Tax Credit through the end of 2022 as a part of the Build Back Better Act.

Without this extension, December will be the final month of monthly payments of the Child Tax Credit. Families will still receive the remainder of the expanded tax credit on their 2021 tax return.