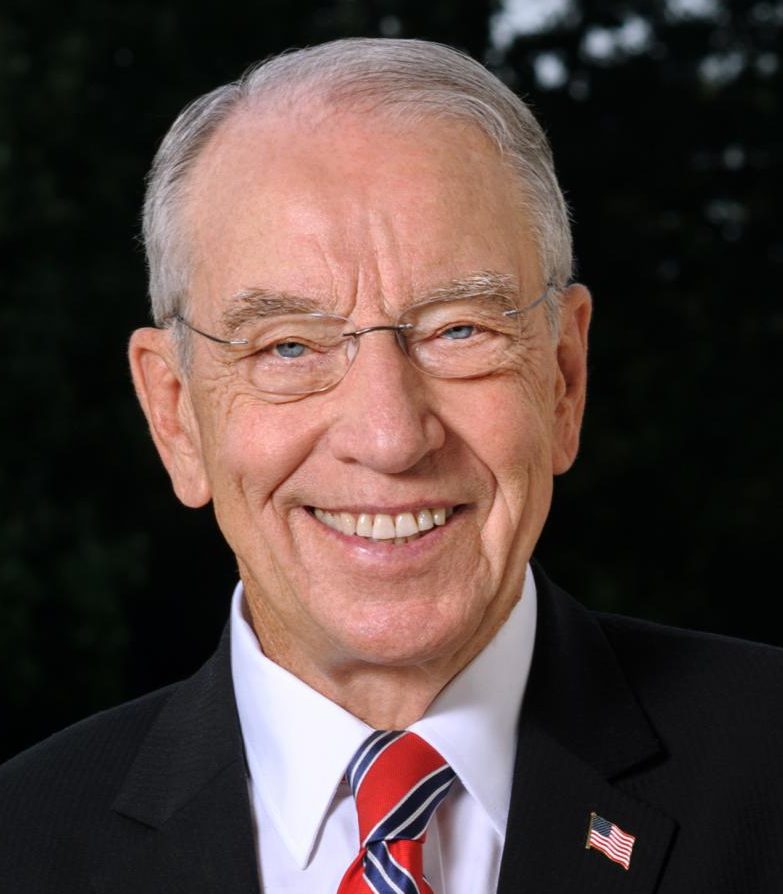

Senate Finance Committee member Chuck Grassley (R-Iowa) joined over a dozen of his colleagues in urging the Congressional Budget Office (CBO) to complete a thorough assessment of the impact higher interest rates will have on the federal debt. The senators express concern that higher inflation, caused by Democrats’ $4.8 trillion in additional deficit spending since January 2021, has led to interest rate hikes that will cause interest payments on the federal debt to soar.

“Rapidly rising yields on U.S. Treasuries have further heightened concerns about the costs associated with servicing the federal debt. As a result of recent rapid growth in net interest costs on the federal debt, federal spending will increasingly be comprised of net interest rather than legislative priorities, reducing lawmakers’ ability to fund critical projects for taxpayers,” the senators wrote.

In May, the CBO raised the 10-year deficit projection by $2.4 trillion – with $1.5 trillion of this projection stemming from higher interest rate expectations. The CBO also noted that the federal debt is on a path to be higher as a percentage of GDP than at any other point in U.S. history.

Grassley and his colleagues ask the CBO to identify what effects persistent inflation and higher interest rates will have on the middle class; reassess its inflationary and interest rate outlook, which was previously released in May of this year; and explain the impact continued negative GDP growth would have on the federal budget.

“Given the upcoming two-day meeting of the Federal Open Market Committee on November 1st and 2nd, at which it is widely expected that the Federal Reserve will raise interest rates by at least 75 basis points, please reply as soon as possible after November 2nd so that lawmakers and the public can be equipped with the most accurate data possible when making policy decisions,” the senators concluded.

Full text of the letter is available HERE.