New data released Tuesday showed that inflation, as measured by the consumer price index (CPI), was 6.0 percent over the last twelve months and 0.4 percent for the month of February. Core CPI, which excludes food and energy, rose 0.5 percent in February and 5.5 percent over the last twelve months, nearly three times the Federal Reserve’s target rate of 2.0 percent. The prices of many consumer staples have increased significantly since January 2021, like roasted coffee up 24%, peanut butter and flour both 34%, eggs 187%, dairy products and cookies both 26%, ground beef 21%, frozen vegetables and butter both 29%, propane 35%, gasoline 51%, electricity 24%, home heating oil 72%, natural gas service 45%, and car insurance 20%.

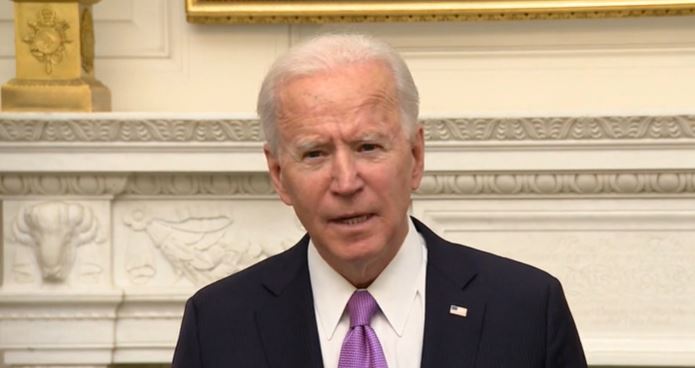

EJ Antoni, research fellow in regional economics with The Heritage Foundation’s Center for Data Analysis, released the following statement Tuesday on the latest data:

“Over the past week, we have witnessed more fallout from the federal government spending, borrowing, and printing trillions of excess dollars than over the previous several years. Not only did artificially low interest rates stoke inflation, but they also have facilitated a potential banking crisis.

“The government’s new bailout of irresponsible financial institutions is further complicating the Federal Reserve’s belated fight against inflation. We are witnessing in real time how misguided government intervention in the marketplace has side effects worse than the original disease. Instead of allowing that same marketplace to return to regular working order, the government continues applying “cures” with harmful side effects.

“The monetary mismanagement has unfortunately been matched by fiscal imprudence, and the latest budget proposal by the White House is no exception. Instead of reducing spending, the Biden administration is pushing for a budget with large deficits that offers no help in bringing down inflation. The trillions of dollars in proposed tax increases will hamstring economic growth and burden American families. Washington must stop growing the federal budget at the expense of the family budget.”