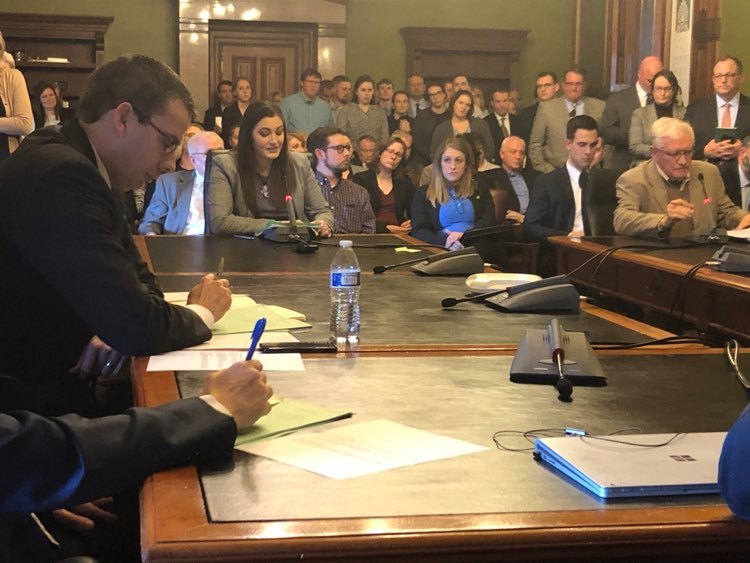

There were few concerns mentioned Wednesday during a subcommittee on the Invest In Iowa Act in the Iowa Senate. The Senators did not make any formal decision on the legislation but wanted to use it as an opportunity to hear from stakeholders.

The Invest In Iowa Act is the proposal of Gov. Kim Reynolds, which would raise the sales tax while cutting income taxes and reduce property taxes.

Logan Shine, the Governor’s legislative liaison, said the bill will invest in current and future generations of Iowa. It will also help retain and recruit new businesses to the state.

Implementing the additional 1-cent sales tax will increase Iowa’s revenue by $540 million. It creates additional tax relief, fully funds the Natural Resources and Outdoor Recreation Trust Fund and fully funds Iowa’s Regional Mental Health System.

According to the nonpartisan Tax Foundation, the plan would move Iowa from 42nd to 20th nationally in income tax.

Many organizations spoke in support of the bill. Concerns were few and far between, though mental health organizations are hoping to retain the ability for counties to use a property tax levy to fund mental health. The plan takes mental health funding out of property taxes and instead funds mental health from the sales tax.

Richard Leopold is the director of Polk County Conservation. He said he was one of the original writers back in 2006 or 2007. He called it the most significant resource bill that natural resources has ever seen.

“I’ve done this for years and years,” he said. “We beg for the crumbs that fall off the table. This puts us firmly at the table.”

Dustin Miller with the Iowa Chamber Alliance said the group is very supportive of the bill. He cited the state’s workforce crisis as a reason to move forward.

“We have lots of jobs out there that need to be filled,” he said. “One way to attract talent to the state is to provide resources for making and maintaining attractive places people want to come to.”

Victoria Sinclair of Iowans for Tax Relief said the bill does cut taxes. While it increases the sales tax, she said it decreases the income and property taxes in the process.

Since 2010, Sinclair said there have been at least eight bills proposed to raise the sales tax without reducing the overall tax burden. With the sales tax all but inevitable, she said it makes sense to do it at a time that allows for thoughtful cuts elsewhere.

“We thank you for holding this subcommittee and allowing this conversation to continue,” Sinclair said. “We applaud this effort to thankfully reduce Iowa’s tax burden and drastically increase the competitive nature of Iowa’s tax code on a national level.”

Sen. Joe Bolkcom (D-Iowa City) said the large turnout for the subcommittee shows the demand and need for more investments in mental health and environmental programs. He said he’s perplexed that Reynolds said the plan has no new revenue in it and no new tax increase.

Bolkcom asked if there’s no new revenue, where the dollars come from for the investments being made. He said he is concerned about taking away the local levy for mental health, calling it a mistake.

Sen. Jake Chapman (R-Adel), who chaired the subcommittee, said he was grateful for Reynolds putting forward a bold agenda that hits on some of the principles he believes in — the quality of life, mental health reform and reducing taxes.

“I do support a consumption tax, I think it is a fair tax,” Chapman said. “So, we’ll continue to have those conversations as we move forward in how we can make Iowa a great state to live, work and raise a family.”