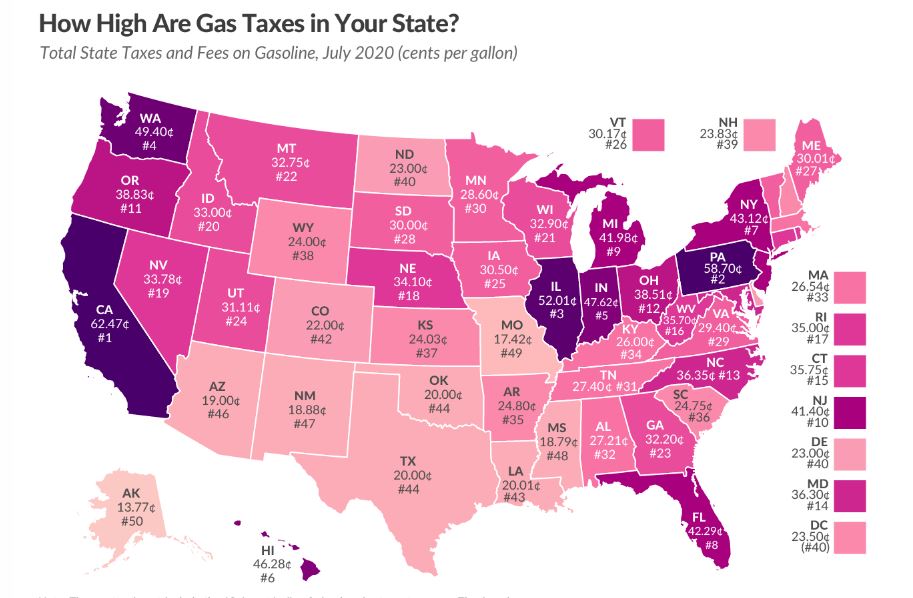

The Tax Foundation released a map last week showing the gas tax rates in each state as of July 2020. Iowa ranks 25th in the country at 30.5 cents per gallon.

California tops the list at 62.47 cents per gallon while Alaska is 50th at 13.77 cents per gallon.

Among neighboring states, Illinois has a gas tax of 52.01 cents per gallon (3rd nationally). Nebraska’s is 34.10 cents per gallon (18th) while Wisconsin is 32.9 cents per gallon (21st).

South Dakota (30 cents a gallon), Minnesota (28.6 cents a gallon) and Missouri (17.42 cents a gallon) are lower than Iowa. Missouri is second to only Alaska with the lowest gas tax.

Janelle Cammenga reports that states levy gas taxes in different ways. She also notes that gas taxes embody the benefit principle of taxation relatively well. Essentially, the taxes someone pay should relate to government services provided to that person.

“In general, drivers benefit from the services that their gas tax dollars pay for, like road construction, maintenance and repair,” Cammenga wrote. “Because gas taxes connect drivers to the costs of road upkeep, they encourage efficient road use, which helps limit congestion and the wear and tear that comes from overuse.”

You can read Cammenga’s article at the Tax Foundation here.