Can you relate to this statement from one of our members? Every year property tax bills seem to increase more than Iowans think they should.

When property taxes grow faster than household budgets they:

- Force people on fixed incomes out of their homes

- Make it harder for young families to afford their first home

- Consume more and more income from renters and homeowners alike

- Allow government bureaucrats to steal choices from taxpayers on how and where to spend their money

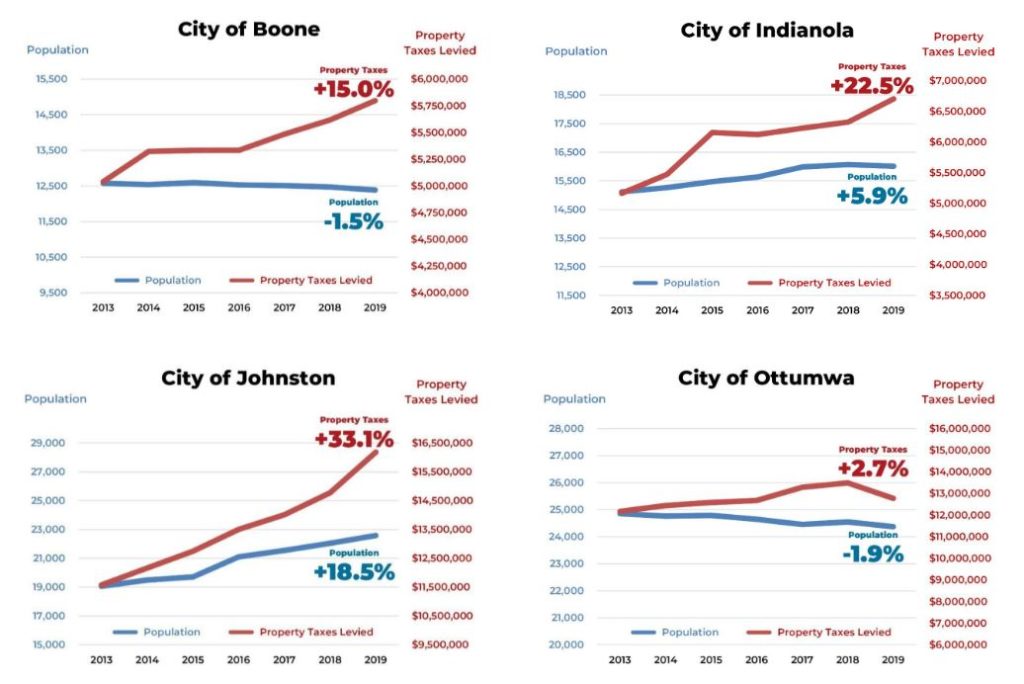

Each city faces different challenges.

When a community is growing, it needs to pay for new infrastructure. Residents might also want, and be willing to pay for, new parks, trails, and flood control. However, many communities are not growing or have other priorities. In both situations, local government taking more money from people through property taxes should be in line with population growth and inflation over a period of time.

ITR collected city budget information from the Iowa Department of Management and population data from the U.S. Census Bureau for the years 2013 through 2019.

Here are four examples of what we found:

As we mentioned, every city is unique but this information does provide a snapshot for you to consider. Think of your household budget. Has your income increased a similar percentage as your property tax bill?

To see this data for the 15 largest cities in Iowa, click here. If you would like us to look up this information for your city, just send an email to [email protected]