The NFIB Research Center released a survey today on the small business loan programs. Small business owners were asked about the Paycheck Protection Program and the Economic Injury Disaster Loan on April 17, the day after the programs ran out of money. About 20% of submitted applications have been fully processed with funds deposited in the borrower’s account, but 80% of respondents said they are still waiting, and many do not know where they are in the application process.

Most small business owners believe it will take beyond 2020 to recover from the economic impact of COVID-19, with only one-third of small business owners believing their community will get back to a normal level of economic activity by the end of the year. A quarter of owners believe it will not be until 2022 or later before the economy returns to normal.

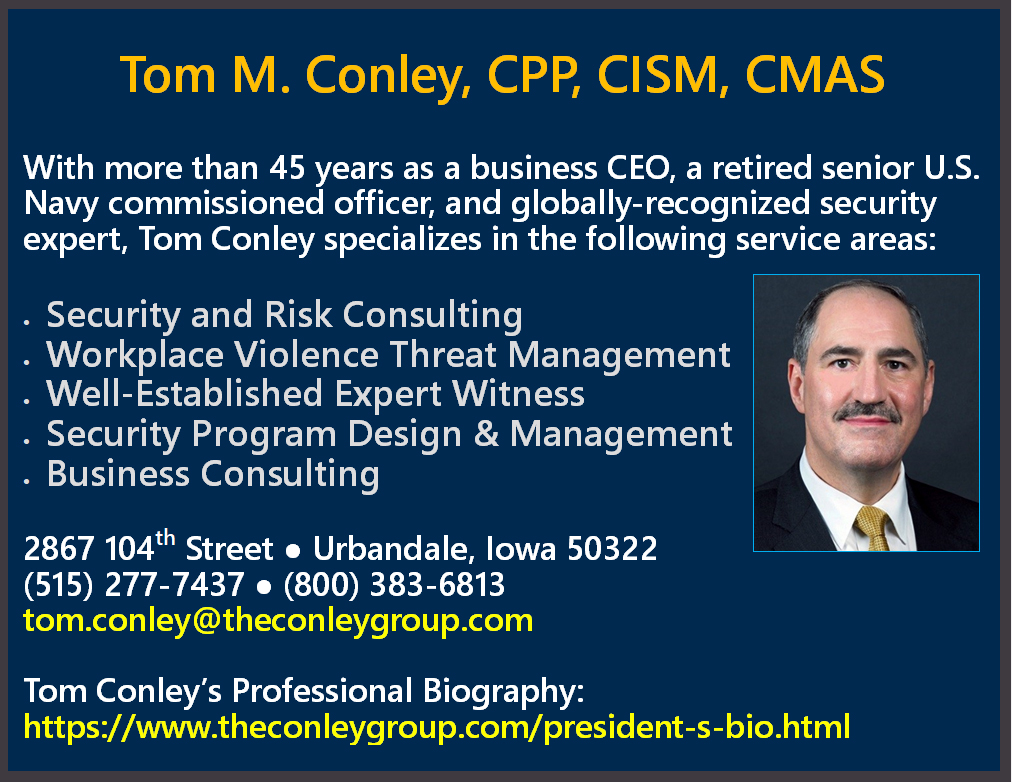

“These survey results are not surprising. I’ve been talking with small business owners every day, and many of the small business owners who are the most desperate for funding are the business owners who are not getting the help they need to survive this crisis” said Matt Everson, NFIB State Director in Iowa. “Congress needs to act now and get Iowa small business owners financial assistance before many of them go under.”

In Milford, Laurie Ray wants Congress to know that small businesses need more funding. She feels fortunate – her small restaurant, Mill Creek, received funding through the Paycheck Protection Program, so she’s able to keep paying her 3 wait staff and two cooks. Without it, she’d have to lay them off. She’s still open for take out, however revenue is down 75%.

Ray is frustrated with the SBA and urges them to fund the Economic Injury Disaster Loan Program. She applied weeks ago and hasn’t heard a peep from the SBA. Ray and her husband also own a car dealership that requires a lot of overhead costs. While she’s grateful that most of the PPP money won’t have to be re-paid, she says it only goes so far. Ray really needs the EIDL loans for cash flow but hasn’t heard a peep from the SBA.

“I feel like Congress has forgotten about small business. While it’s important to fund big companies, the little guys are being left behind. I’m lucky that I’m informed and I knew which loans to apply for and when – but a lot of small business owners don’t. They’re too busy just trying to survive. Everyone talks about the PPP but we also need the EIDL loan,” said Ray.

Key Findings of the Survey Include:

About three-quarters of small business owners (almost all employer businesses) have submitted an application for a PPP loan as of April 17.

- About one-in-five (20%) of submitted applications have been fully processed with funds deposited in the borrower’s account.

- Nearly 80% are still waiting, many not knowing where they are in the process.

About 40% of small business owners successfully submitted an application for an EIDL through the SBA website.

- Among those who submitted an application, most (77%) requested the emergency grant of up to $10,000.

- Of those who requested the EIDL emergency grant, about 10% have received the funds.

- Essentially, all of the EIDL applicants (99%) have yet to receive the loan.

Most small business owners believe it will take beyond 2020 and into the years following to get back to normal economic activity.

- About one-third of small business owners believe their community will be back to a normal level of economic activity by the end of the year.

- Just under 40% believe more normal levels of economic activity will return in 2021.

- A quarter of owners believe it will not be until 2022 or later before the economy returns to normal.

The full survey is available here.