“My assessment increased $50,000. I’m sure my county board will just sit on their hands and let higher valuations increase the flow of tax dollars to their coffers.” This comment was sent to us by an ITR member yesterday.

You might understand where she is coming from. Property owners received, or will soon receive, their new assessments. For most Iowans, their home’s valuation has probably gone up. In Polk County, for instance, residential assessments have increased 7.5 percent and commercial valuation grew 9.2 percent.

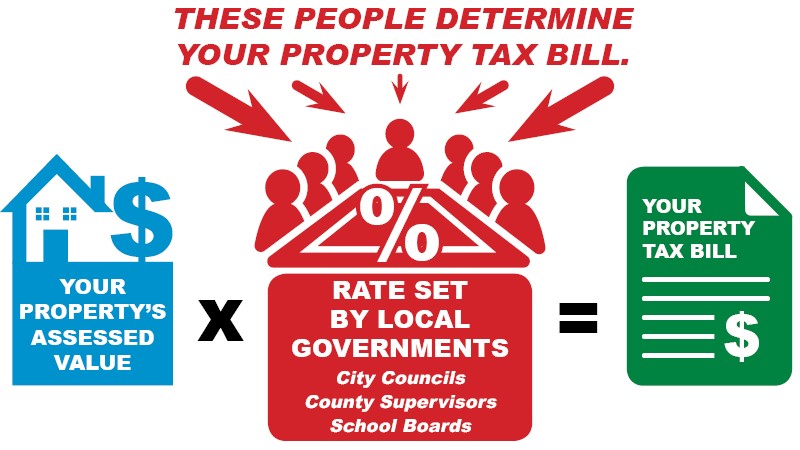

Who controls your property tax bill?

There is much anger directed at county assessors, but they do NOT determine your bill. In fact, your tax bill can decrease even when your property’s value increases. But that rarely occurs because local government spending always seems to grow.

Assessments are updated every two years, and the values are one part used to calculate property tax bills. However, members of your city council, the county board of supervisors, and school boards have the most impact on your final bill when they set their budgets.

It’s their spending that creates your tax bill.

Some local governments are doing a good job holding the line on spending. Others are riding the wave of increased assessments. As we heard this year, many local elected officials proudly said property tax rates are staying the same or not increasing. Property tax bills continue to grow when the tax rate doesn’t change because local elected officials don’t want to make hard decisions. It’s what one of our members described as “sitting on their hands.”

What happened to property tax transparency?

The property tax transparency reform passed two years ago requires public notice and an extra hearing if a taxing authority’s budget is two percent greater than the previous year’s budget.

While this was a significant step forward, the problem is too few Iowans have taken advantage of this new process to voice their concerns.

Most Iowans do not follow their local governments’ meeting agendas and are unaware of the budget process. They may not know when or where they may voice opposition to a property tax increase.

ITR is working on new tools to make this easier. Look for more info soon.

Back to your property’s assessment. What can you do?

If you think your property’s assessment is unreasonable, you can file a protest to appeal the value. But, don’t wait. Protests must be filed between April 2 and April 30.

Links:

Learn more about protesting your assessment

Petition to Local Board of Review form (must be filed by April 30)