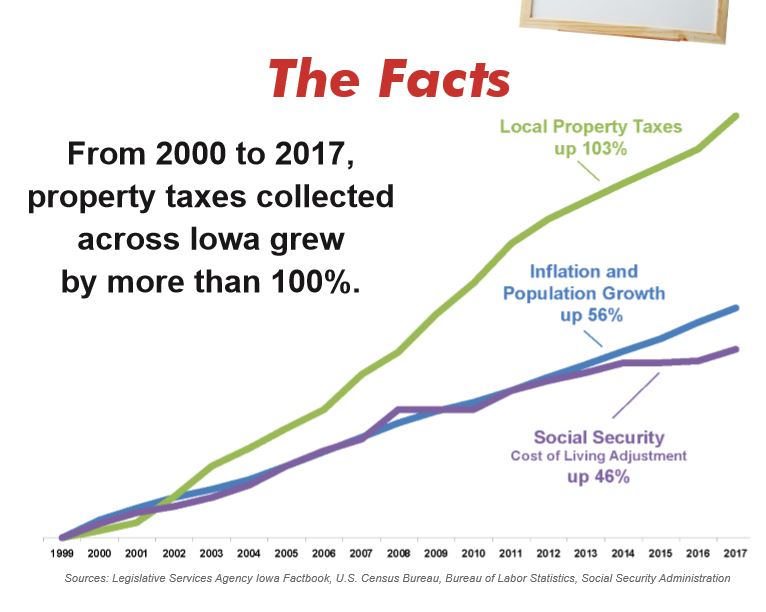

Many Iowans were shocked by their recent property assessments and concerned about the effect on property tax bills. Public opinion polls reveal a majority of Iowans believe it is time to tackle the issue of high property taxes.

One of our members said, “I bought a townhouse to downsize and my taxes are now way higher than my house ever was. I work full time and am living on a single income. There aren’t enough raises for people to live now.”

Iowa’s high property tax burden must be addressed, and the most effective policy would be to control the growth of property taxes. How? By focusing on local government spending and making sure there is more accountability and transparency. Both can be achieved by implementing a Truth in Taxation process that would create transparency triggers for local governments.

A property tax reform bill that the Iowa House of Representatives is considering right now would require additional transparency if a city or county proposes budget increases of more than two percent above the previous year, followed by a public hearing where citizens can weigh-in on the proposed budget, and then an affirmative vote by the council members or supervisors.

Starting with a baseline of growth of two percent would help control the growth of property taxes and still allow for funding government priorities. Local governments would then just have to justify why the extra spending above two percent is necessary.

New York, which is not known for a taxpayer-friendly tax code, recently made permanent their property tax cap which limits the annual growth of taxes levied by local governments and school districts to two percent, or the rate of inflation, whichever is less. Their property tax cap has saved property taxpayers billions. The Empire State’s limit contains an override mechanism, so it is not a hard spending restraint. It is more accurately considered a soft which requires local government to rationalize their spending and take a vote to go beyond the allotted two percent growth.

Perhaps the most effective accountability and transparency measure is a strong Truth in Taxation process, with Utah serving as the gold standard. Utah’s Truth in Taxation law requires an extensive public notification and hearing process if a local government wants to increase taxes.

Utah’s Truth in Taxation has prevented local governments from receiving a tax increase just because property assessments have increased, which is the primary problem with Iowa’s property tax system. In Utah, if property valuations increase, then the resulting tax rate is ratcheted down to prevent local governments from automatically capturing additional revenues.

To collect more property taxes in Utah, local governments must clearly and plainly explain to taxpayers how the budget they are considering will impact the tax bills of property owners. This requires local governments to be more accountable to their constituents and it also forces government to be more transparent by holding a public hearing and taking a vote on a proposed tax increase.

Increasing accountability and transparency should never be a controversial issue. High property taxes are not only harmful for economic growth, but they are also burdensome for individuals, families, and businesses. A transparency trigger would help control the growth of property tax bills, while delivering needed accountability and transparency to Iowa’s property tax system.