Q: How has the Paycheck Protection Program helped small businesses keep their workforce?

A: When the COVID-19 pandemic led to severe economic fall-out for small businesses across the country, Congress provided a financial lifeline to help employers stay afloat and keep their workers on payroll. The CARES Act created the Paycheck Protection Program (PPP), a $349 billion fund to provide federally-guaranteed loans to small businesses administered by local lenders. The loans would be forgivable if borrowers applied at least 60 percent of the money towards payroll expenses, including employee vacation, parental, family, medical, and sick leave. Other qualifying PPP expenses included interest on mortgage, rent and utility payments.

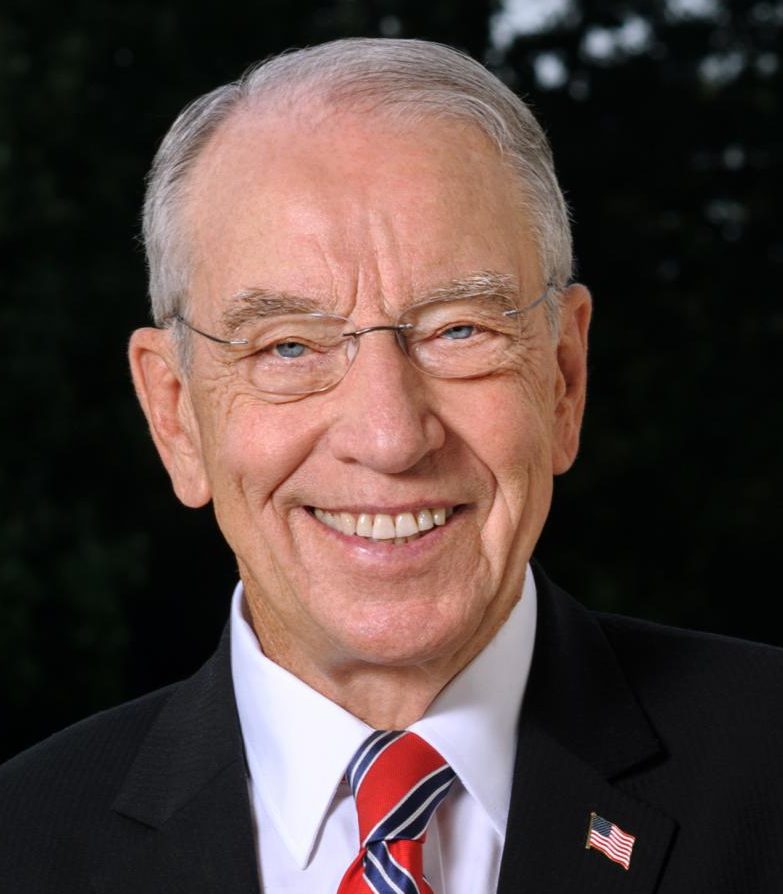

President Trump signed the CARES Act on March 27th and the Small Business Administration (SBA) acted swiftly to implement the program within a week. Across Iowa, more than 61,000 businesses received $5 billion in PPP funds to help retain their workers and meet financial obligations during the pandemic. According to the SBA, the overall average loan size was $101,000. As Congress finalizes agreement on a fourth pandemic relief package, I support extending additional PPP funding urgently needed to help small businesses survive, including first-time borrowers, enhancing flexibility for spending the funds and simplifying the paperwork process for lenders and borrowers while also keeping check on fraud.

However, the IRS threw a wrench into the program’s effectiveness and ignored congressional intent. The IRS issued a notice in May providing that small businesses who used their PPP loan to pay for expenses that typically qualify for a tax deduction would not be allowed to deduct these expenses if they are paid with a forgiven PPP loan. This would create a substantial tax burden and cash flow problem for businesses already struggling to stay afloat. I urged the Secretary of the Treasury to reverse this decision. Unfortunately, the Department of Treasury and the IRS doubled down on the guidance, reaffirming in November that PPP recipients may not deduct business expenses paid for with forgiven PPP loans. That means the expenses paid with PPP loans are included in income, effectively making the forgiven PPP loan taxable. This directive ignores congressional intent to exclude loan forgiveness from taxable income. Increasing the tax burden on small businesses already hanging on by a thread to survive is poppycock. For example, a small business that used a $150,000 PPP loan to help pay wages and benefits for their employees might now be required to pay approximately $55,500 in federal income taxes due to denied deductions for necessary business expenses. This is bad timing, bad policy and very bad for small businesses.

Q: How are you trying to fix the PPP tax glitch?

A: As chairman of the tax-writing Senate Finance Committee, I’m leading a bipartisan legislative effort to reverse the Treasury Department’s misguided decision and allow small businesses to deduct expenses paid for with PPP money. As Congress works to finalize negotiations on a fourth pandemic relief package before the end of the year, I’m pushing to include this legislative fix to give peace of mind and certainty to small businesses who have struggled to serve their customers, keep their workers and save their livelihoods in an unprecedented year of uncertainty and financial disruption. Small businesses are the economic backbone and lifeblood of communities across America. We can’t allow the pandemic to force small business to buckle under through no fault of their own. Reducing unnecessary tax and regulatory burdens attached to PPP funding makes sense and is the right thing to do. Based upon feedback from Iowa businesses and their lenders shortly after implementation of the Paycheck Protection Program, I supported efforts in Congress to replenish funding with an additional $310 billion and to secure flexibility for borrowers to make the best use of this financial lifeline for their individual operations. Like any government program, Congress must pay close attention on how this money is spent to ensure tax dollars are used as effectively and efficiently as possible. In this case, that means applying common sense and cutting red tape that puts unnecessary burden on job creators and their workforce. The bottom line is simple. Congress enacted the PPP to give a financial lifeline to small businesses, not deliver a financial tax liability. The last thing small businesses deserve in 2020 is a lump of coal from the IRS in their stocking.