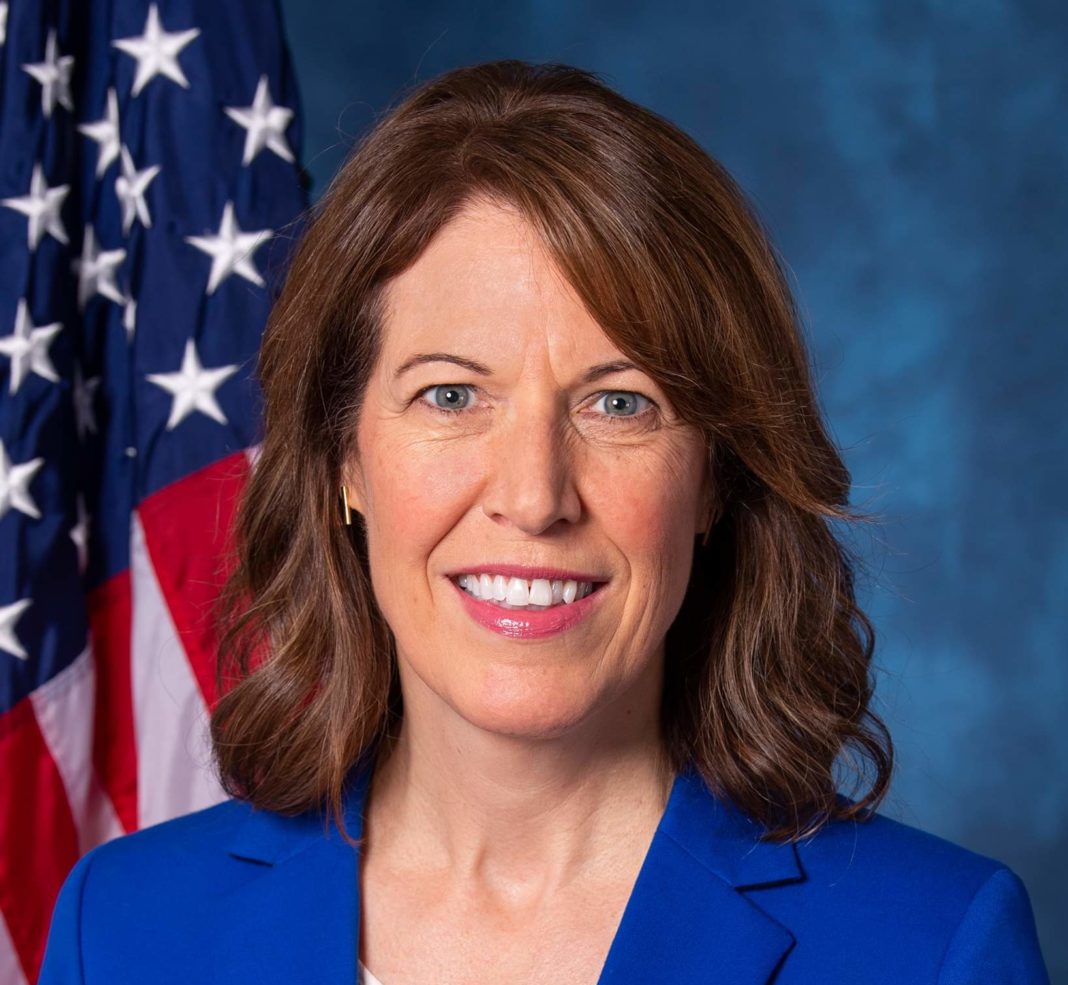

On Wednesday, Rep. Cindy Axne (IA-03) introduced commonsense legislation that would end taxpayer subsidies for prescription drug advertisements targeted at American consumers by big pharmaceutical companies.

Under current law, drug manufacturers are allowed to deduct the cost of advertising expenses from federal taxes, meaning taxpayer dollars are used to subsidize drug advertisements.

“Iowans are paying more than ever for their prescription drugs while giant pharmaceutical companies clear record profits in part by exploiting loopholes in our tax code to flood our airwaves with T.V. ads subsidized by Iowa tax dollars. This is unacceptable and insulting to the Iowans who tell me at every town hall I hold the incredible lengths they are going to just to afford their medications,” said Rep. Axne. “I’m proud to join Congresswoman Slotkin and Congressman Trone to introduce legislation that will cut off these tax breaks for drug companies and stop my constituents’ tax dollars from funding the never-ending carousel of prescription ads on their televisions.”

The No Tax Breaks for Drug Ads Act would prohibit any tax deduction for direct-to-consumer (DTC) prescription drug advertising, thereby making sure that taxpayer money isn’t being used to subsidize drug ads.

The bill would cover any ad that refers to a prescription drug product and is primarily targeted to the general public, including through journals, magazines, newspapers, broadcast media such as radio and television, and digital platforms such as social media and web applications.

DTC advertising expenses by pharmaceutical companies have more than quadrupled over the past two decades, rising from $1.3 billion in 1997 to $6 billion in 2016. In that same time period, advertising from drug companies has increased from 79,000 ads to 4.6 million ads, including 663,000 TV commercials.

Support

The No Tax Breaks for Drug Ads Act was introduced in the U.S. House of Representatives yesterday with Reps. Elissa Slotkin (MI-08) and David Trone (MD-06).

“For years, American taxpayers have been subsidizing the horrible ads that drug companies run on TV to promote their own products to the tune of billions of dollars. It’s time for those subsidies to stop,” said Rep. Slotkin. “Most Michiganders can barely turn on their TV without seeing one of these ads, which usually promote the most expensive name-brand drugs. Taxpayers shouldn’t be the ones footing the bill on behalf of the biggest pharmaceutical companies in the world, especially when many of these companies are paying more for TV ads than on research for new drugs. Lowering the cost of prescription drugs has long been important to me, and closing this tax loophole is an important part of getting the job done.”

“While millions of Americans struggle to pay for life-saving medications, pharmaceutical companies are using a loophole to avoid paying billions of dollars in taxes. Rewarding companies with tax breaks when they continually increase their prices for consumers is just bad business,” said Rep. Trone. “It’s about time these companies pay their fair share. The No Tax Breaks for Drug Ads Act will do just that.”

“Drug corporations that continue to inflate profits in the middle of a global health pandemic while tens of millions suffer here at home and around the globe should not be rewarded with subsidies for their advertising expenses that cost taxpayers even more money,” said Margarida Jorge, Campaign Director for Lower Drug Prices Now. “This is corporate welfare of the worst kind. We applaud Congresswoman Slotkin for introducing this vital piece of legislation and hope Congress will swiftly pass it.”

The Senate companion of this bill was introduced by Sen. Jeanne Shaheen (D-NH).