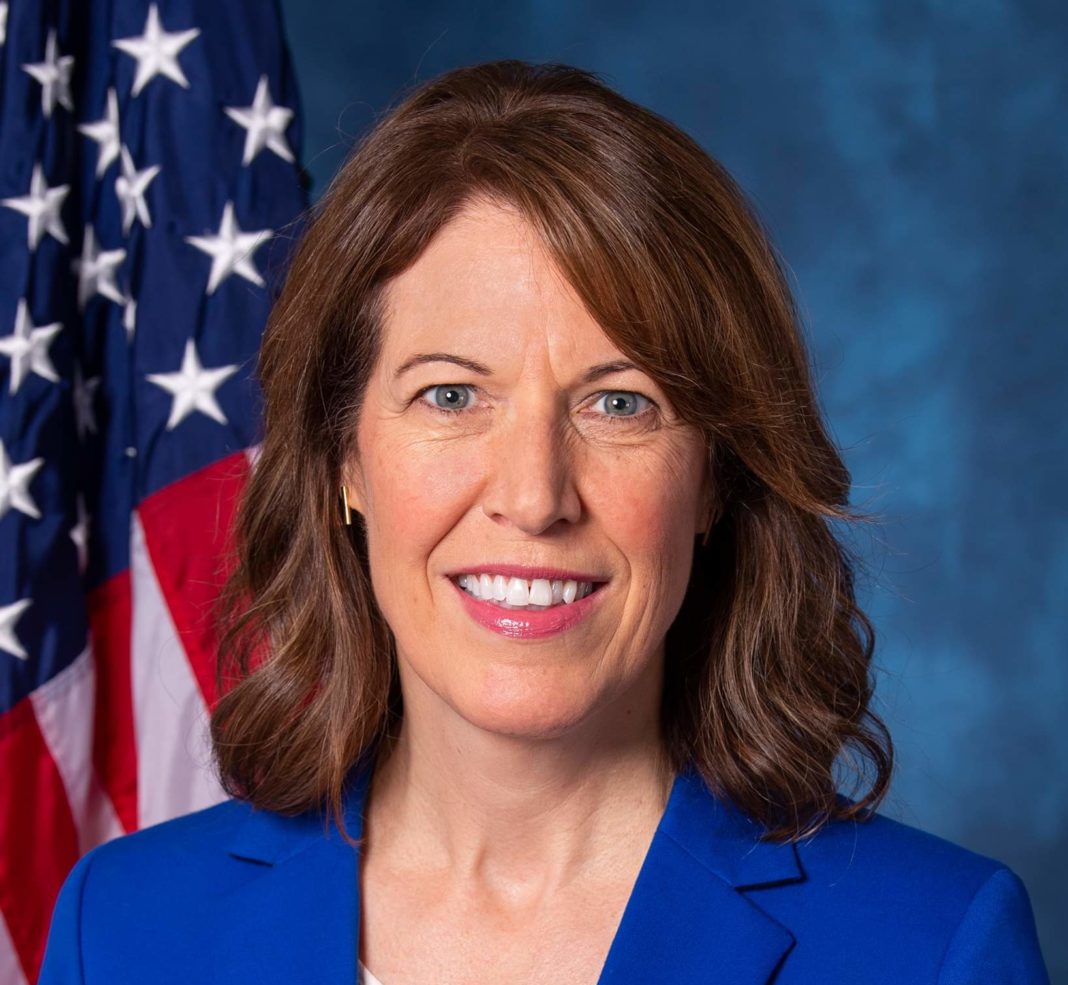

Today, Rep. Cindy Axne (IA-03), and Rep. Chris Pappas (NH-01) introduced legislation to help people and businesses that sell goods online better understand when they need to report earnings from their sales to the Internal Revenue Service.

The Cut Red Tape for Online Sales Act will raise the threshold on when sellers who use online marketplaces or peer-to-peer payment systems will receive a 1099-K form to report their earnings to the IRS from $600 to $5,000. It will also require the IRS to include language explaining when sellers need to file the form.

“Tax rules surrounding peer-to-peer payment systems and online marketplaces are unnecessarily confusing,” said Congresswoman Axne. “I had to start selling my household items using an online marketplace just so I could pay my medical bills when my son was born. I know how hard that is to go through, and folks who are forced to make decisions like that shouldn’t be sent forms telling them that they may owe money to the IRS on transactions that aren’t taxable. This bill will help clear up confusion for the increasing number of people and businesses who sell goods online.”

“Selling online has empowered Granite Staters to supplement their income and find a second life for used goods by connecting with buyers online,” said Congressman Pappas. “A used good sold for less than the original purchase price will not create any taxable income, yet these transactions will now trigger IRS reporting requirements, yielding confusion and ultimately overreporting of income. Raising the reporting threshold will ensure sellers of used goods are not subject to burdensome or confusing reporting requirements, which could result in overpayment as well as ineligibility for certain tax benefits.”

U.S. Senator Maggie Hassan (NH) will be introducing companion legislation in the Senate.

In December 2021, Rep. Axne joined several colleagues in a letter to House leadership asking for Congress to raise the threshold for 1099-K reporting for goods sold on marketplaces before the end of the year.

The legislation would:

- Raise the reporting threshold from $600 to $5,000.

- Require entities to issue a plain-language description of the taxability of income reported on Form 1099-K to reduce confusion among online sellers.