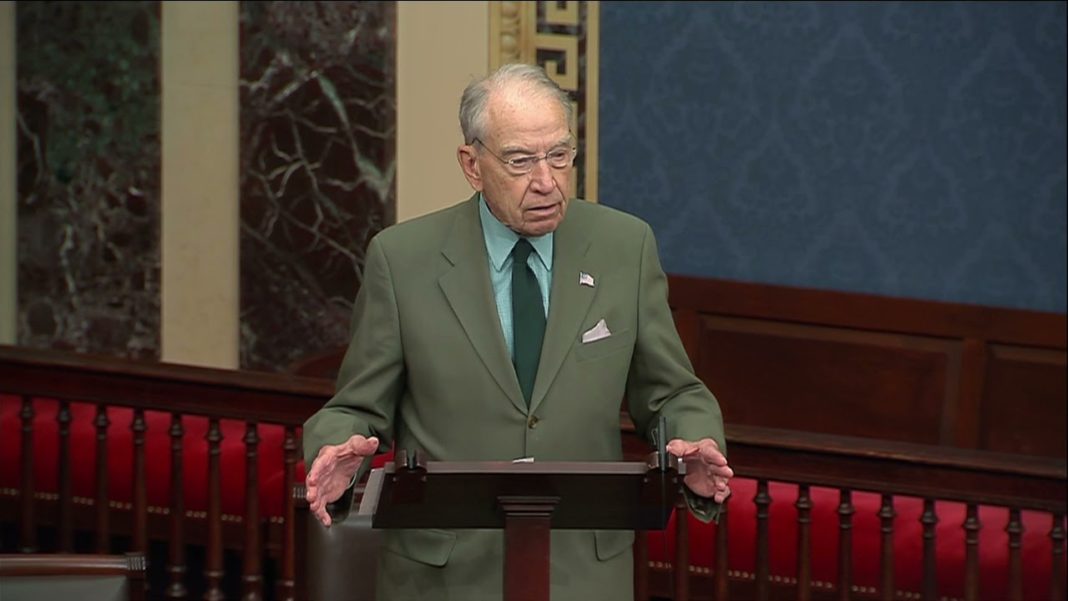

We are now in the final week of tax filing season. While filing season typically ends on April 15, this year taxpayers have until May 17 to file or request an extension.

This is also the third filing season under the tax cuts and reforms Republicans enacted in 2017. For the vast majority of Americans, this means they are paying significantly less in income taxes than they were under prior law.

Moreover, thanks to a nearly doubling of the standard deduction, most American’s are paying less without the headache of itemizing their taxes.

More importantly, prior to the pandemic, tax reform contributed to the best economy America had seen in decades.

Unemployment reached 50 year lows and was at or below 4 percent for 24 consecutive months. Family incomes and workers’ wages experienced robust gains. In fact, wage growth was strongest for low-wage workers. As a result, we actually saw income inequality decline.

Unfortunately, the current Administration’s ambitions to use the pandemic as an excuse to pass a big-government anti-growth agenda threatens our return to a thriving economy.

First came their $2 trillion untargeted COVID relief bill that focused more on enacting a liberal wish list rather than pandemic relief. The dangers of passing this untargeted and largely unnecessary spending are already beginning to weigh on our economic recovery.

Throughout the economy prices are soaring and job growth is tepid. April jobs growth data fell short of expectations by more than 700,000 jobs.

This is deeply concerning. I’ve heard first hand from business after business in Iowa that they are desperate for workers, but job applicants are scarce.

As my Republican colleagues and I have warned our Democrat colleagues for months, this is the natural result of their policies that pay people more not to work then to work.

Yet, despite the obvious overreach of their liberal agenda, my Democrat colleagues are preparing to double down with an additional $4 trillion dollar big-government spending spree.

And to finance their progressive dreams, they are proposing trillions of dollars in job killing tax hikes.

Their proposals to roll back critical reforms to our corporate tax system would result in the U.S. once again having the highest corporate tax rate among our major trading partners and incentivize companies to move headquarters abroad.

Small businesses are also in their cross hairs. Family run businesses and farms could be decimated by proposals to hike capital gains taxes and subject paper-only gains in family business assets to tax immediately upon transfer at death.

My Democrat colleagues’ tax policies would make the U.S. a less attractive place to invest, erode American competitiveness, and slow our nation’s post-pandemic economic recovery. That means fewer jobs and lower wages for middle-class Americans.

Post-pandemic prosperity won’t be achieved through higher taxes and big government spending programs. It will be achieved through pro-growth policies and unshackling our economy from stringent pandemic era restrictions as we move toward a vaccinated world.