Q: How did the Trump tax cuts grow the economy?

A: The Constitution gives Congress the power of the purse strings. The people’s branch decides how to raise revenue and how to spend it. There’s a rule of thumb tax writers must appreciate before legislation gets enacted into law. When something is taxed, you get less of it. Lawmakers use the tax code to shape spending, saving and investing and set fiscal policy to help prime the economic pump. For example, tax incentives help families save for college, secure home ownership, strengthen retirement security, foster economic development, and boost renewable energy, among other policy initiatives. Punitive taxes influence consumer behavior, such as making it more expensive to use tobacco and alcohol products. By definition, taxing wages and investment income means less take-home pay for American workers. Every dollar that’s collected by the government means one less dollar for Americans to save, spend, donate and invest in their families, businesses, and communities.

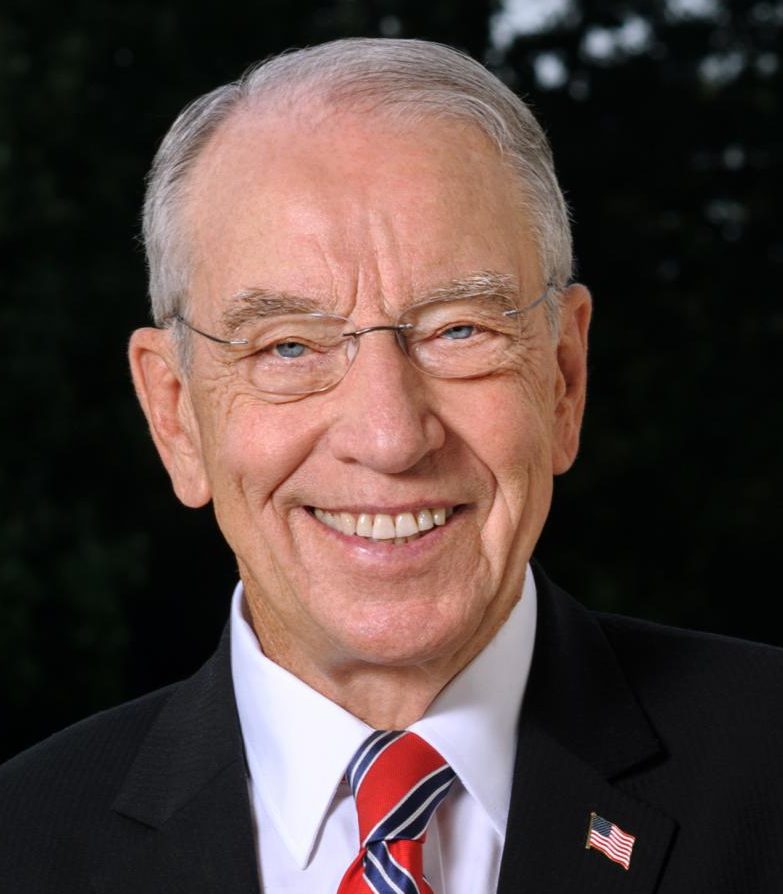

As chairman of the tax-writing Senate Finance Committee, I ascribe to a “less means more” philosophy. Less taxes means more economic growth and job creation. When President Trump took office in 2017, we delivered historic tax relief to the American people that set in motion the largest economic expansion in modern history. The Tax Cuts and Jobs Act simplified the tax filing process for more than one million Iowa households who took advantage of Congress doubling the standard deduction. It increased take-home pay for Iowans across-the-board, doubled the child tax credit and eliminated the penalty imposed by the Affordable Care Act’s individual mandate. What’s more, the Trump tax cuts unleashed economic growth across America, allowing businesses to invest in their workforce, raise wages and expand operations. In September, the IRS released income statistics from 2018. The data confirm tax policy 101. Cutting taxes puts more money in people’s pockets. What’s more, the data confirm the Trump tax cuts delivered the biggest slice of relief to middle-income families. Between 2017 and 2018, Americans with incomes between $50,000 and $100,000 saw their tax liability reduced by twice as much as wealthier Americans with incomes above $1 million. Households with adjusted gross income (AGI) of $50,000 to $74,999 enjoyed a 13.2 percent reduction in average tax liabilities. Households with AGI of $1 million or higher saw a 5.8 percent reduction in average federal tax liability, according to IRS statistics.

Q: Would tax increases put the economic recovery at risk?

A: Yes. Any proposal that calls for rolling back the Trump tax cuts and raising taxes is a bad idea, especially right now. It goes against the grain of tax policy 101. When you tax something, you get less of it. Raising taxes on businesses would damage our economic recovery and put the brakes on job creation, start-ups and wage growth. Raising taxes on American businesses ignores the progress we made to target abuse in the Tax Cuts and Jobs Act. Let’s not forget under the Obama-Biden administration, U.S. tax laws allowed companies to defer their foreign earnings unless and until they were brought back to the United States. As a senior member of the tax-writing Senate Finance Committee, I targeted this off-shore loophole. We enacted a minimum tax on what’s known as global intangible low-taxed income (GILTI). I also worked to prevent abusive use of deductions made to foreign affiliates and imposed limits on the deductibility of interest. Our changes to the tax law cracked down on these abuses, expanded the tax base, encouraged on-shore investment and grew the economy. Unraveling these reforms would propel U.S. companies to shift and shelter profits overseas. That’s bad for American jobs and deprives revenue from our military, public health programs and public services. Raising taxes on U.S. businesses fails to understand how our global supply chains work. During my county meetings in Iowa, I heard from manufacturers who’re struggling from disruptions due to the pandemic. For example, slapping on a 10-percent penalty on goods and services imported by U.S. companies from foreign affiliates would boomerang into a foreign tax on U.S. goods and services exported from America. As the adage goes, the only certainties in life are death and taxes. Increasing taxes now would sound the death knell to the employment gains and surge in economic opportunity among communities of color unleashed by the Tax Cuts and Jobs Act. According to the Joint Committee on Taxation and Congressional Budget Office, at least one-quarter of the corporate tax is borne by the workforce. So, raising taxes on businesses means they would be shouldered by working men and women across the country through fewer jobs, reduced wages and less benefits. Policymakers who glibly say wealthy Americans and big corporations must pay their “fair share” are misleading or ignoring how tax laws work. Even President Obama understood the risk of raising taxes during an economic recovery, “The last thing you want to do is raise taxes in the middle of a recession.” As far as I’m concerned, that is doubly true as America navigates a post-pandemic recovery.