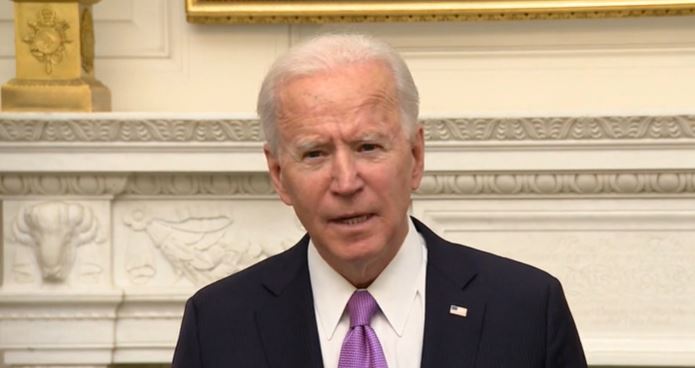

Bloomberg News is reporting that President Joe Biden is preparing to institute the “first major federal tax hike” in nearly three decades.

The move comes after Biden signed the $1.9 trillion COVID relief package.

Bloomberg News said that the next initiative “is expected to be even bigger” and it won’t rely just on government debt as a funding source.

“While it’s been increasingly clear that tax hikes will be a component — Treasury Secretary Janet Yellen has said at least part of the next bill will have to be paid for, and pointed to higher rates,” Bloomberg News reported.

It is expected that corporate tax rates and the individual rates for high earners will be increased.

Elements to the increase could include raising the corporate tax rate from 21 percent to 28 percent; paring back tax preferences for pass-through businesses; raising the income tax rate on individuals earning more than $400,000; expanding the estate tax’s reach and a higher capital-gains tax for individuals earning at least $1 million annually.