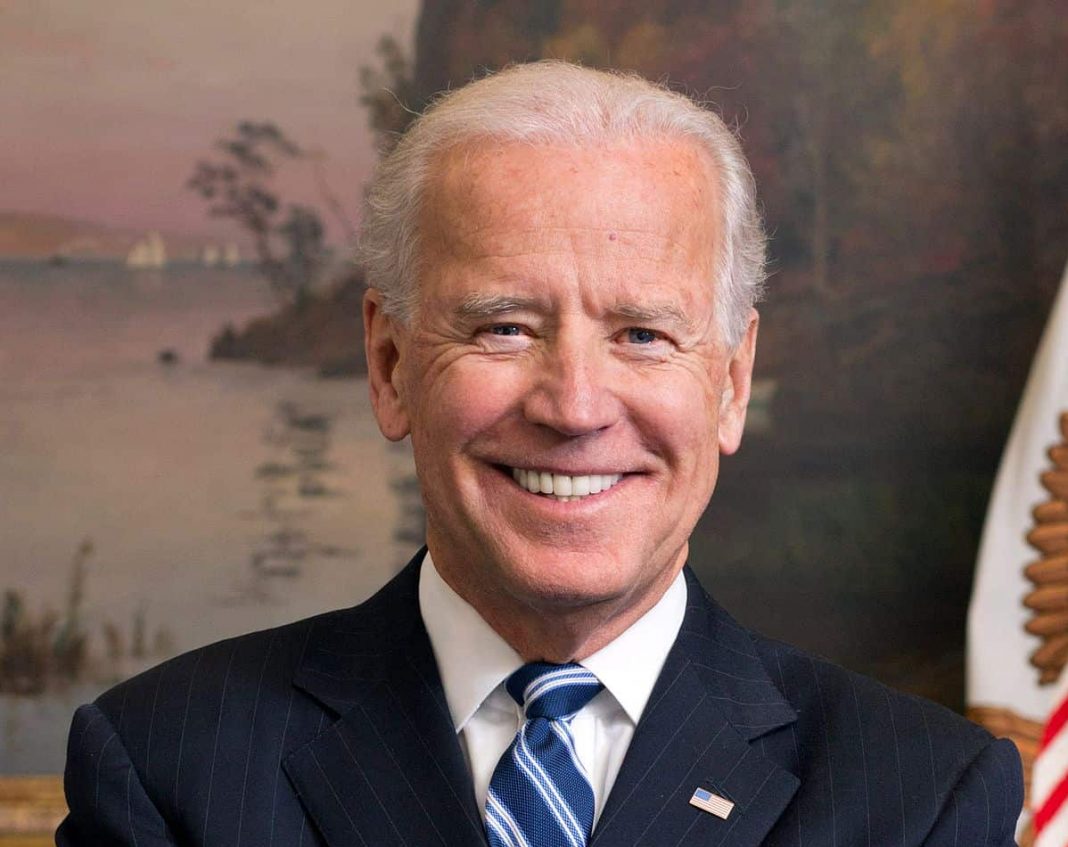

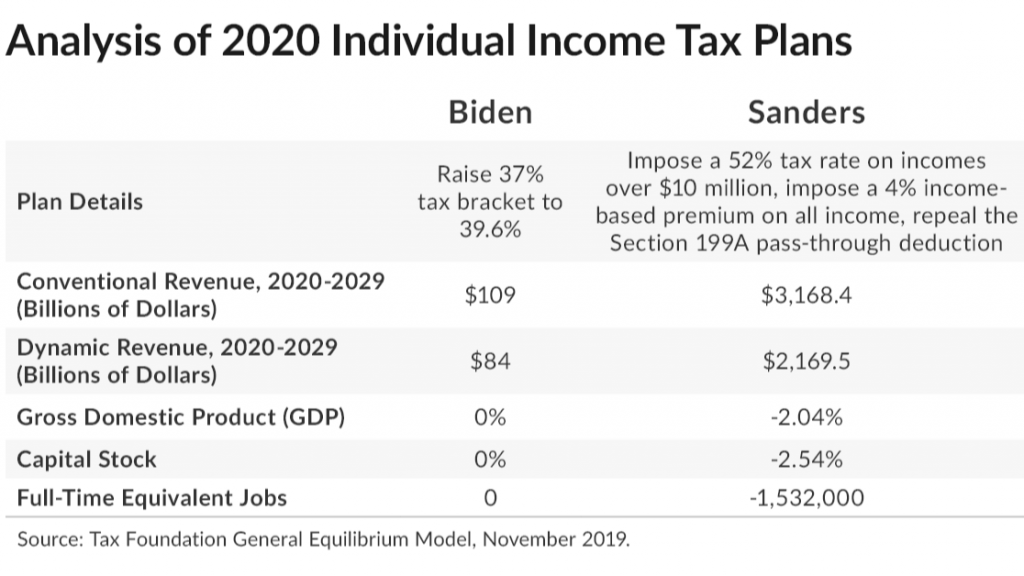

Joe Biden and Bernie Sanders have each proposed changes to the individual income tax, one of the largest sources of federal revenue.

Our new analysis compares the economic, revenue, and distributional effects of the various proposals:

Joe Biden’s proposal would reverse the TCJA top marginal rate cut from 37 percent back up to 39.6 percent. This change would not have a long-run effect because this tax cut is already scheduled to expire after 2025, and as such, Biden’s proposal is not a change to long-run policy.

Bernie Sanders proposes a new top marginal rate of 52 percent on incomes above $10 million, a 4 percent tax on all households, and repeal of the Section 199A pass-through deduction.

Sanders’ individual income tax proposal would reduce after-tax incomes of taxpayers, lowering the return to labor and increasing the cost of capital for pass-through businesses.

We estimate Sanders’ plan would reduce long-run employment by about 1.5 million fewer FTE jobs.