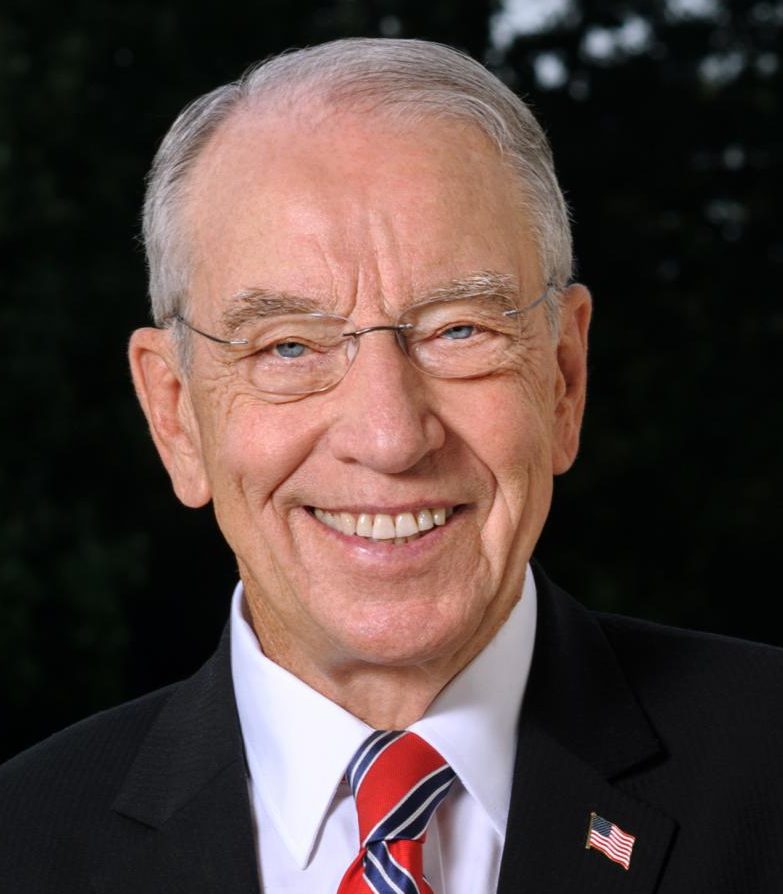

Sen. Chuck Grassley (R-Iowa) joined Sen. Tom Udall (D-N.M.) in introducing the bipartisan Fair Returns for Public Lands Act of 2020, S. 3330, to update the nation’s antiquated public lands royalty system and ensure that taxpayers get fair returns on leases of public lands for oil and gas production.

“Low royalty rates on oil produced on federal lands has deprived the federal treasury of billions of dollars. Today marks 100 years since Congress passed the Mineral Leasing Act of 1920. Since then, the royalty rate has not been addressed. This is just one example of Big Oil saying it wants a free market, but lobbying for taxpayer-funded corporate welfare. It’s time for my colleagues in Congress to end this oil company loophole, end the corporate welfare and bring oil leasing into the 21st century,” Grassley said.

“Public lands and their natural resources belong to the American people, and it’s only fair to ask those who profit from them to return a fair share to taxpayers. Oil and gas companies are paying significantly higher royalty rates offshore and on many state and private lands, and there is no need to give federal onshore producers a sweetheart deal at a time of record U.S. production along with rising climate change and habitat impacts. After one hundred years of the Mineral Leasing Act, it is high time for real reform that gives state and federal taxpayers their fair share of royalties that fund important education, infrastructure, public health and environmental needs in communities across the country and particularly in the West. I am proud to introduce this commonsense, bipartisan bill with Senator Grassley to ensure that New Mexicans and the American people get a fair deal when they let for-profit companies operate on their public land,” Udall said.

The legislation modernizes the public lands leasing system for the first time since royalty rates were set a century ago in 1920. The legislation increases both the share of royalties that taxpayers receive from public lands leasing as well as rental rates. The new rate reflects the current fair market value, while the bill also establishes minimum bidding standards to lease public lands. Similar measures implemented in Texas and Colorado did not affect the states’ overall production.

According to studies by the Congressional Budget Office (CBO) and Government Accountability Office (GAO), modernizing public lands royalty rates for oil and gas could increase federal revenues by as much as $200 million over the next decade with little to no impact on overall production. The bill would increase the royalty rate from the 12.5 percent rate established by the Mineral Leasing Act of 1920 to 18.75 percent. Many states have already updated royalty rates for public lands leasing to as much as 25 percent, double the current federal rate.

The federal royalty adjustment will also benefit taxpayers on the state level. Taxpayers for Common Sense calculated that New Mexico’s state government has lost an estimated $2.5 billion in revenue over the last decade because of outdated federal rental rates, below-market royalty rates, and waste from oil and gas wells, with federal taxpayers losing an equivalent amount as well.

The Fair Returns for Public Lands Act of 2020 would modernize public lands leasing policy by:

Adjusting Royalties: The bill will increase royalty rates on new or reinstated leases to 18.75 percent over the current royalty rate of 12.5 percent established in 1920 under the Mineral Leasing Act. CBO estimates that an increase to 18.75% would generate $200 million in net federal income over the next 10 years, with an equivalent amount being dispersed to the states based on current revenue-sharing laws. An increase to 18.75 percent will put onshore oil and gas royalty rates on par with offshore rates and on par with many state royalty rates – a strategy that the CBO concluded would have negligible impacts on oil and gas development.

Minimum Bids: The legislation will increase minimum bids for leasing public lands to $10 per acre. Current minimum bids are only $2 per acre. Higher minimum bids will encourage oil and gas developers to more selectively purchase leases and clarify the companies’ intentions of pursuing actual exploration and development. The legislation will also set a $15 per acre minimum fee for an expression of interest to lease a specified location – known as “nominating” a parcel of public land. This fee will reimburse administrative costs for processing nomination requests and deter speculators from nominating wide swaths of public lands at one time.

Rental Rates: Rental rates will increase to $3 per acre for the first five years and $5 per acre for the next five years. These increases account for inflation since the first rates were established in 1987. Additionally, reinstated leases will be subject to rental rates of $20 per acre and royalty rates at 25 percent. The bill also establishes mandatory adjustments to ensure that rental rates account for inflation and adjust at least every four years.

The full bill text can be found HERE. A background summary can be found HERE. A section-by-section summary can be found HERE and statements of support including a list of supporting organizations can be found HERE.