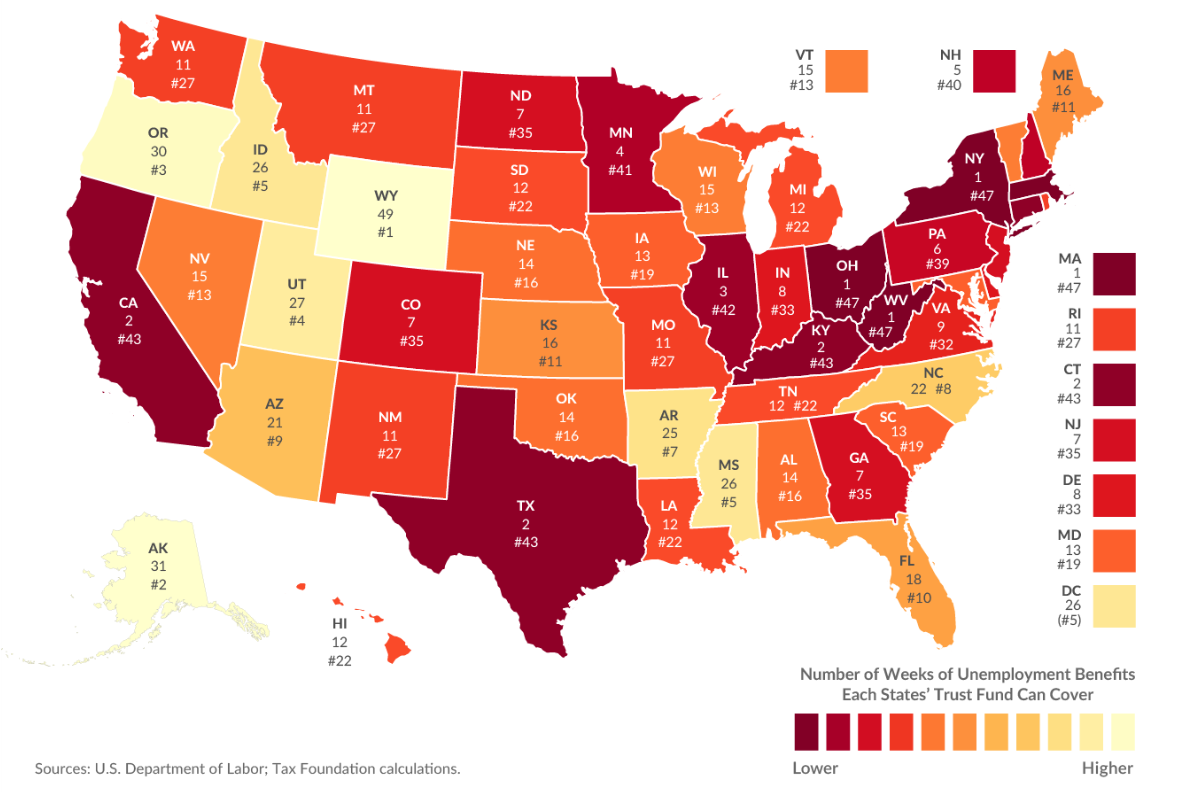

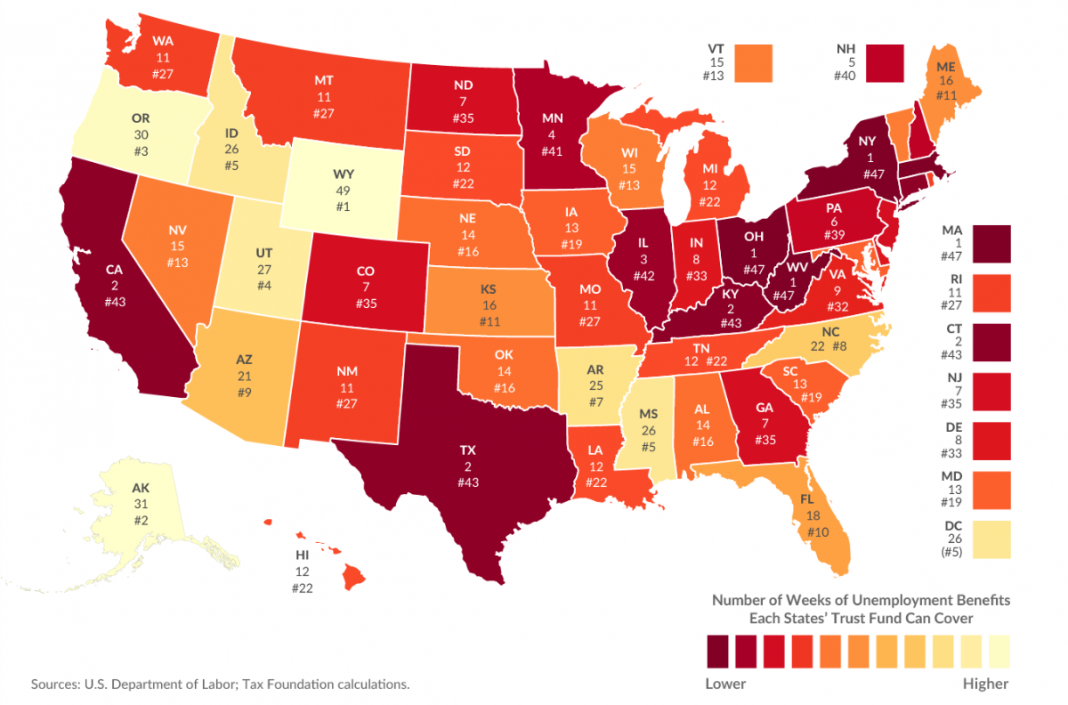

Four states—Massachusetts, New York, Ohio, and West Virginia—only have enough funding left to pay out a week’s worth of benefits based on those who have filed for or are receiving benefits to date (since payments lag claims, it may take an additional week or two for funds to be fully exhausted).

California, Connecticut, Kentucky, and Texas only have two weeks of funding left, while Illinois has three weeks.

If all the states’ funds were pooled together, they could cover about seven weeks of payments based on current claims levels, but wide disparities exist.

According to the Treasury Department, California, Connecticut, and Illinois have already been approved for federal loans in anticipation of the exhaustion of their trust funds, and reports indicate that New York has filed as well.

States must repay these advances (with interest starting in 2021), and if they still have outstanding balances after two years, in-state businesses will face higher federal unemployment insurance taxes to compensate for the state being in arrears.