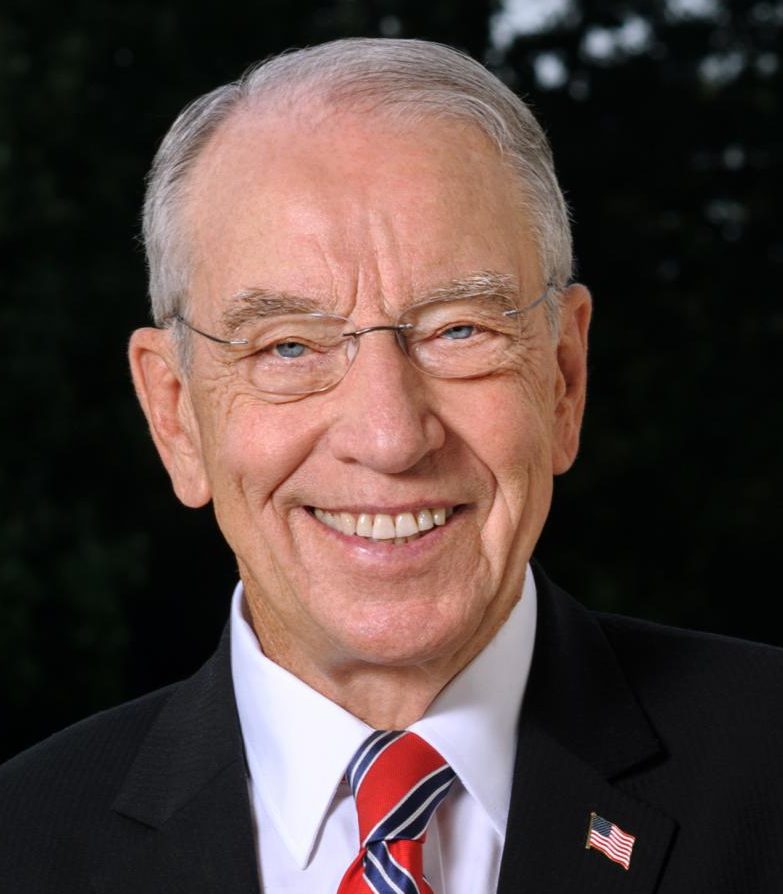

From Sen. Charles Grassley’s press release:

The Internal Revenue Service (IRS) provided data to the Senate Finance Committee showing that the Private Debt Collection (PDC) program, a public/private partnership that works to bolster the U.S. Treasury, strengthen the effectiveness of the IRS and ensure fairness in the federal tax system, continues to demonstrate that it can more than pay for itself with revenues returned to the Treasury.

“This program is helping make the system fairer to those who follow the law and fulfill their civic responsibility. Letting those who shirk their tax responsibilities off the hook isn’t fair to law-abiding taxpayers who do pay their taxes,” Grassley said. “The IRS private debt collection program continues to prove its value. The most recent data again shows that revenue returned to the U.S. Treasury exceeds all associated program costs. That’s something we don’t often see here in Washington. The pace of collections is also accelerating, showing the full potential of the program has yet to be achieved.”

For Fiscal Year 2018, the PDC program brought in $51 million in revenue after costs. In less than the first three months of Fiscal Year 2019, the program brought in $30 million in revenue after costs.

The program’s total revenue, taking start-up costs into account, is $53 million, and the total amount provided to the IRS is more than $23.6 million. Those funds are now beginning to be used to hire and train additional IRS compliance personnel who will be available to help increase the agency’s efficiency and responsiveness to American taxpayers.

Grassley was instrumental in creating the IRS’ bipartisan Private Debt Collection Program as chairman of the Senate Finance Committee in 2004 as well as its reinstatement in 2015 after the IRS terminated it in 2009 following a flawed review of the program.