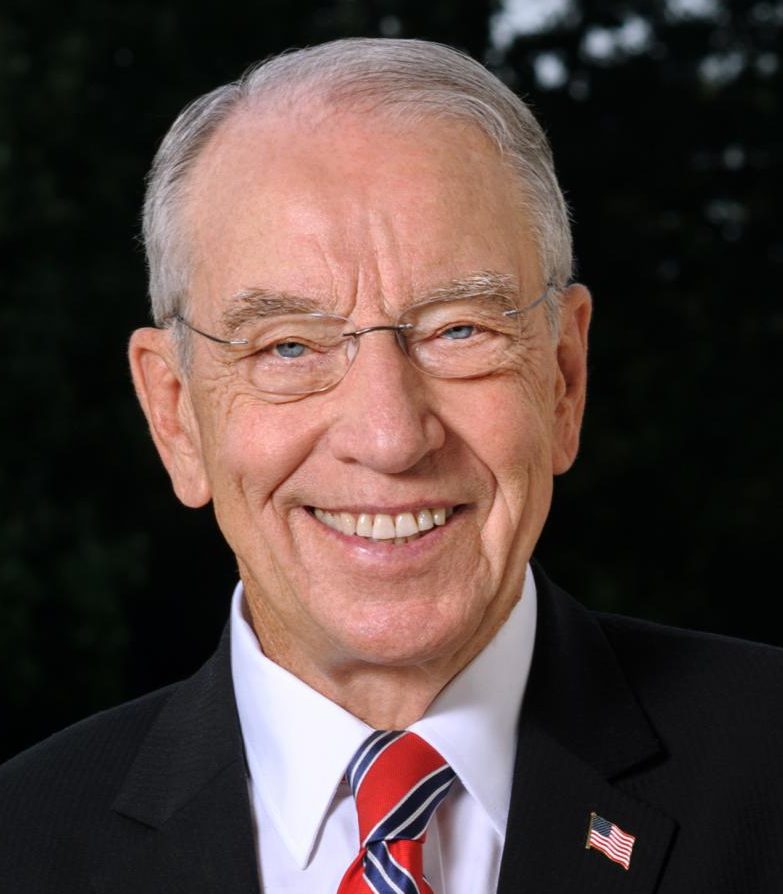

By Senators Chuck Grassley & Susan Collins

Newsweek

It’s business as usual these days in Washington: months of procrastinating as a looming fiscal disaster roils the markets, followed by a last-minute deal that nobody really likes, only to set another deadline for the next fiscal crisis.

It’s the way we’ve operated for years. Congress consistently fails to adopt a budget or pass government funding bills, prompting a needless game of chicken with a government shutdown right around the holiday season. As a result, we end up passing massive funding packages with little time to review. This haphazard gambit almost always leads to more deficits and higher debt. Eventually, we hit the statutory debt limit and fight about how to respond. We scrounge up enough votes to prevent an economically devastating default and promise to take steps some day in the future to prevent it from happening again.

Rinse and repeat.

It wasn’t always this way. Between 1981 and 2000, Congress adopted a budget every year but one, and the Senate regularly debated and amended all of the annual appropriations bills. Since 2008, however, we’ve adopted a budget only eight times, and the Senate has only debated one or more appropriations bills seven times.

Budget inaction has caused our fiscal outlook to deteriorate. Between 1974 and 2000, the federal deficits—annual government funding in excess of revenue—averaged 2.7 percent of our economy. They’ve nearly doubled since then, and the Congressional Budget Office projects deficits will average 6.1 percent of our economy over the next decade. For perspective, deficits previously only topped 6 percent of our economy during World War II, the 2009 financial crisis, and the recent pandemic.

Public debt is already nearly as large as our nation’s entire annual economic output. The Government Accountability Office recently warned that, “If policies don’t change, debt will continue to grow faster than the economy.” CBO advises that debt this high and rising “tends to slow economic growth, push up interest payments [and], heighten the risk of a fiscal crisis.”

Left unaddressed, our rapidly rising debt will choke the government’s ability to meet its obligations for essential programs. By 2050, interest payments alone will become the single biggest government expense—even larger than Social Security, Medicare or defense funding.

So how do we reverse this unsustainable trend?

Here’s a radical thought: We actually adopt a budget in a timely manner. After all, that’s among Congress’ chief responsibilities. Bipartisan budget reforms similar to those proposed by the late Sen. Mike Enzi and Sen. Sheldon Whitehouse, past and current Senate Budget Committee chairmen, would help restore a budget routine and promote fiscal sanity.

First, that effort started by establishing a two-year budget cycle with realistic and enforceable deadlines. The funding and taxing committees would be included in the early stages of the annual budget process to develop an informed plan for funding and revenue.

Reforms would also set a debt-to-Gross Domestic Product target to focus the budget on putting our nation’s debt on a sustainable path. Increases in the statutory debt limit would be linked to the passage of a budget resolution, preempting the kind of default pandemonium that the nation just endured.

The sooner a budget is adopted, the sooner appropriators can get to work setting funding levels, eliminating the perennial threat of government shutdowns.

None of these proposals is particularly dramatic. They’ve all received bipartisan support in the past, so there’s no reason not to move forward to restore fiscal discipline and avoid future funding and debt debacles.

Unfortunately, while the Budget Committee has held nine hearings on climate change this year, with more in the hopper, committee Democrats haven’t found time to write a budget or even debate the budget reforms needed to fix the process.

With the debt limit debate in the rear-view mirror, there’s no better time to revisit budget reform. We invite Chairman Whitehouse and all our colleagues to engage in this debate and put an end to governing from fiscal crisis to fiscal crisis.