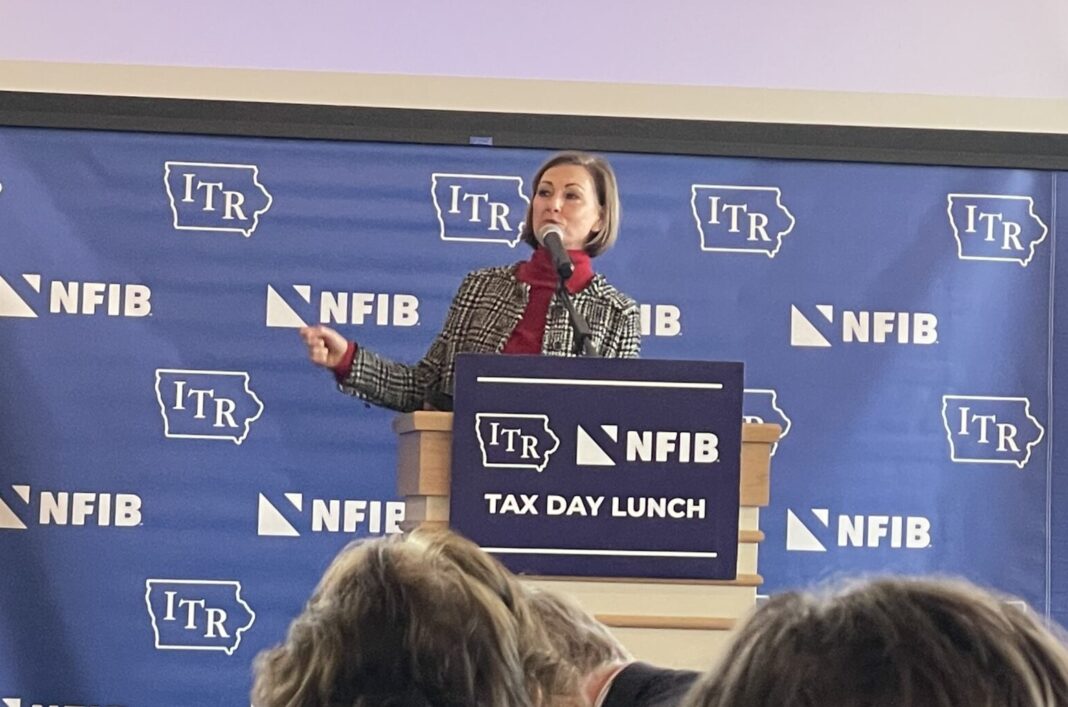

In announcing Iowa’s $1.83 billion surplus, Governor Kim Reynolds stated her desire to continue cutting taxes in 2024, “Some see a surplus as government not spending enough, but I view it as an over collection from the hard-working men and women of Iowa… I look forward to cutting taxes again next legislative session and returning this surplus back to where it belongs – the people of Iowa.”

Senator Dan Dawson, Chair of the Senate Ways and Means Committee, was more succinct. He responded to the news on Twitter by simply stating, “Accelerate. Lower. Eliminate.”

As a result of fiscal conservatism, Iowa’s economy and financial foundation is strong. Because of the $1.83 billion fiscal year 2023 surplus, Iowa’s reserve accounts will have a balance of $902 million, and the Taxpayer Relief Fund will grow to $2.74 billion. And more budget surpluses are projected to accumulate in future years.

Governor Reynolds and her limited government colleagues in the legislature have placed a priority on lowering income taxes in recent years. Since 2018, the Governor and the legislature have been reducing both individual and corporate income tax rates. In 2022, Governor Reynolds signed into law not only the largest income tax cut in state history, but it was also the most comprehensive tax reform measure in the nation. Iowa’s nine-bracket progressive income tax is being phased out until a flat 3.9 percent rate is achieved for individuals in 2026.

Another part of the 2022 tax reform law was implementing a revenue trigger to lower the corporate tax rate. As a result of strong corporate tax revenues the rate will be lowered from 8.4 percent to 7.1 percent starting in 2024. This provides further evidence of the strength of Iowa’s economy because the 7.1 percent rate was projected to occur in 2027. The corporate rate will continue to be reduced until it reaches 5.5 percent.

The reality is that even while Iowa has been phasing in three rounds of tax cuts, revenue is still exceeding expectations. Put more bluntly, the state is still taking too much money from Iowa families and businesses.

Prudent budgeting is at the heart of fiscal conservatism. During this past legislative session, the legislature enacted an $8.5 billion budget for fiscal year 2024, which only spends 88 percent of projected tax collections. This was only a slight increase from the $8.2 billion fiscal year 2023 budget. Even while keeping spending growth restrained, the priorities of government are still being met, including increased funding for education.

Iowans don’t have to follow legislators on Twitter to understand the importance of the state’s budgeting practices. They could also consider the wisdom of President Calvin Coolidge who regarded “a good budget as among the most noblest monuments of virtue.” For Coolidge, fiscal conservatism or “economy in government” was a moral issue. Governor Kim Reynolds reflects not only the spirit of Coolidge, but she is a true champion of fiscal conservatism.

Iowa’s strong fiscal foundation that made multiple rounds of tax cuts possible remains in place, creating the opportunity for more pro-growth policies in 2024 and beyond. “We’ve seen what the powerful combination of growth-oriented policies and fiscal restraint can create, and now it’s time for Iowans to directly receive the benefits,” stated Governor Reynolds.

Iowa is demonstrating that fiscal conservatism works.