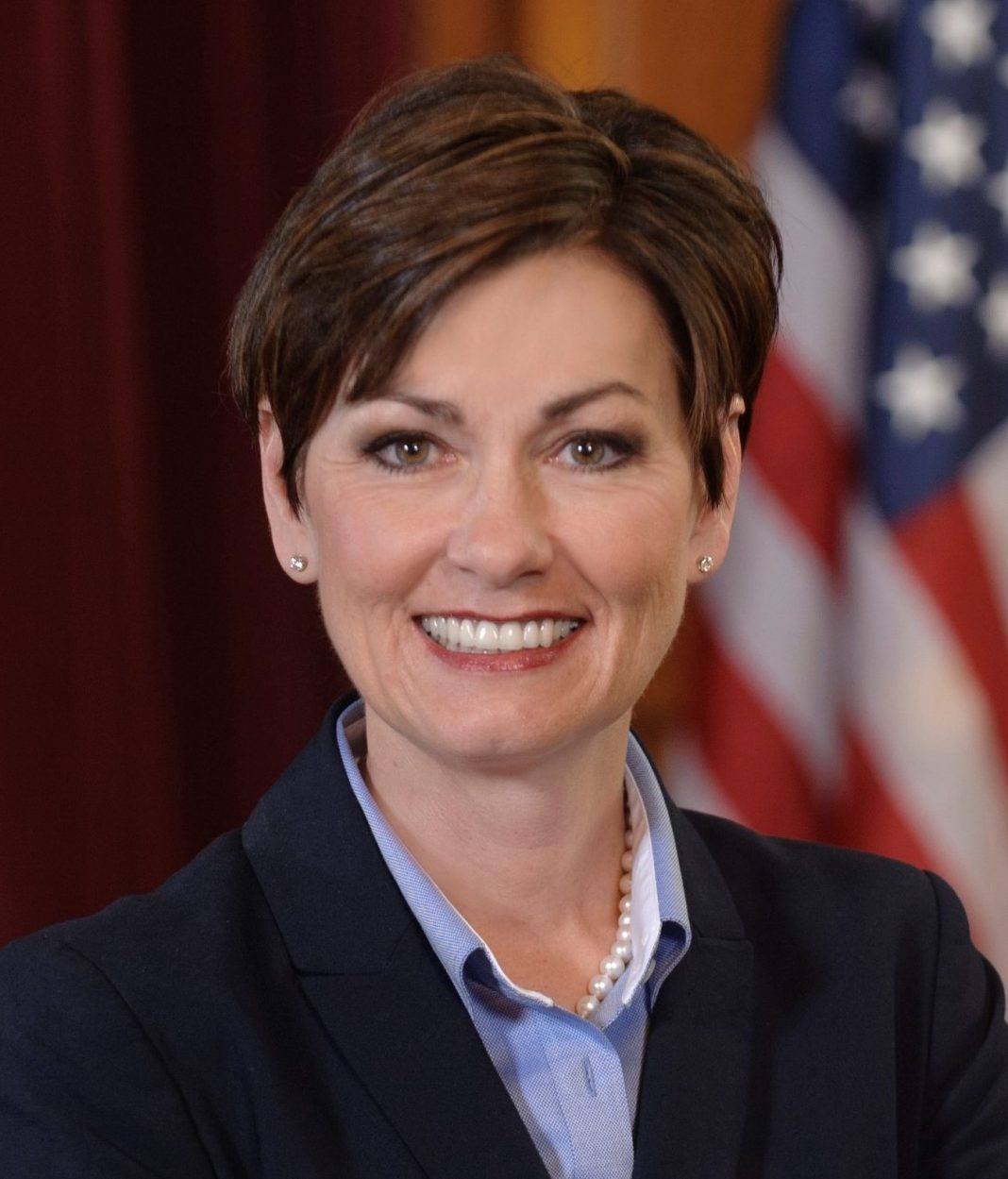

The Iowa Standard was able to talk with Joel Anderson last week. Anderson is the tax policy expert for Gov. Kim Reynolds. We spoke with Anderson about the Invest In Iowa Act.

Reynolds has been traveling the state to inform Iowans about her plan as well as receive feedback. While the sales tax does increase under the plan, it provides an overall tax reduction when cuts to income taxes and property taxes are taking into consideration.

There will also be additional sales tax exemptions for feminine hygiene products and diapers. An increase in childcare tax credits is also included.

“The sales tax increase actually impacts very little,” Anderson said. “Collectively, we all pay it, but it’s also something that companies out of state and citizens driving through pay as well.”

One point of emphasis under the plan is increasing the quality of life for Iowans.

“More and more she goes to these town halls and more and more people are coming up and saying they used to go duck hunting with their family all the time and they really want to make sure it’s still around for the next generation,” Anderson said. “Same with fishing, biking, the water trail system — can we develop a whole industry around that?”

The plan also provides a more stable source of mental health funding, Anderson said. That funding would no longer be drawn from property taxes. Instead, it would come from the sales tax.

“If we don’t do anything now, there is something in two years where that system is going to be in real trouble just from not having funding,” Anderson said. “Property taxes would have to increase if we don’t do something now.”

Finally, the only way to fund the Natural Resources and Outdoor Recreation Trust Fund is to increase the sales tax.

Anderson said when the Iowa Revenue Estimating Conference’s report comes out, Iowans will see the state is growing. And, thanks to Reynolds’ ability to budget at 95 percent, Iowa has a surplus.

“We believe this is a responsible way of returning the surplus to the taxpayers and not allowing for surpluses to grow as much in the future,” Anderson said. “That’s why she’s always going to be committed to that 95 percent budget.”

Better drinking water, a higher quality of life and protecting Iowa’s resources are some of the benefits of the Invest In Iowa Act. Reynolds put together a plan that accomplishes all of that without an overall tax increase. Perhaps more important than anything else, the plan provides more stable funding for mental health.

Reynolds will continue to travel the state and the legislature will surely continue working on the issue as well.

“This is her starting point,” Anderson said. “We’re open to any ideas to further that conversation.”