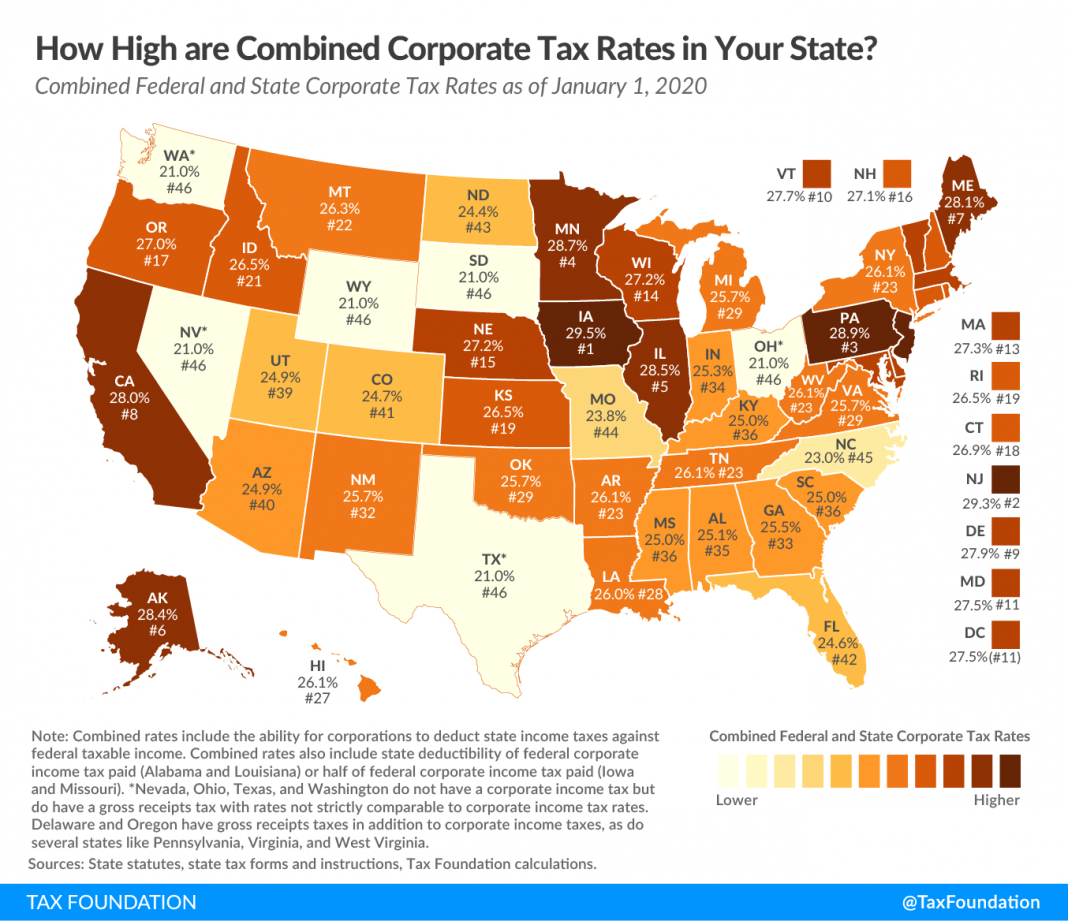

According to the Tax Foundation, Iowa is No. 1…

But it’s in combined corporate tax rates.

Garrett Watson of the Tax Foundation wrote that corporations in the U.S. pay federal corporate income taxes levied at a 21 percent rate. In addition, states also levy taxes on corporate income.

Forty-four states, as well as Washington D.C., have corporate income taxes on the books. The top marginal rates range from 2.5 percent in North Carolina to a top marginal rate of 12 percent here in the Hawkeye State.

Iowa’s 29.5 percent combined rate “leads” New Jersey’s 29.3 percent. Pennsylvania is third (28.9 percent), Minnesota is fourth (28.7 percent) and Illinois is fifth (28.5 percent).

For comparison sake, California is eighth (28 percent) while New York is 23rd (26.1 percent).