Too often, we hear elected officials brag about keeping the property tax levy rate low. They are misleading the voters. Taxpayers don’t care about the levy rate; they care about the ever-increasing amount of their property tax bill!

One ITR member shared with us:

“Property taxes are my largest monthly payment except for my mortgage. At least my mortgage is fixed and doesn’t increase. I don’t see my property tax payment remaining steady or decreasing… EVER.”

Why do property taxes increase?

Many people think the increasing value of a property is the reason their tax bill grows. It isn’t. Local government spending is the reason, and spending is controlled by city council members, county supervisors, and school board members.

When any level of government takes dollars out of your pocket, those who create the tax should be able to clearly explain why they need your money than you do and where they will spend it.

Are all property taxes out of control?

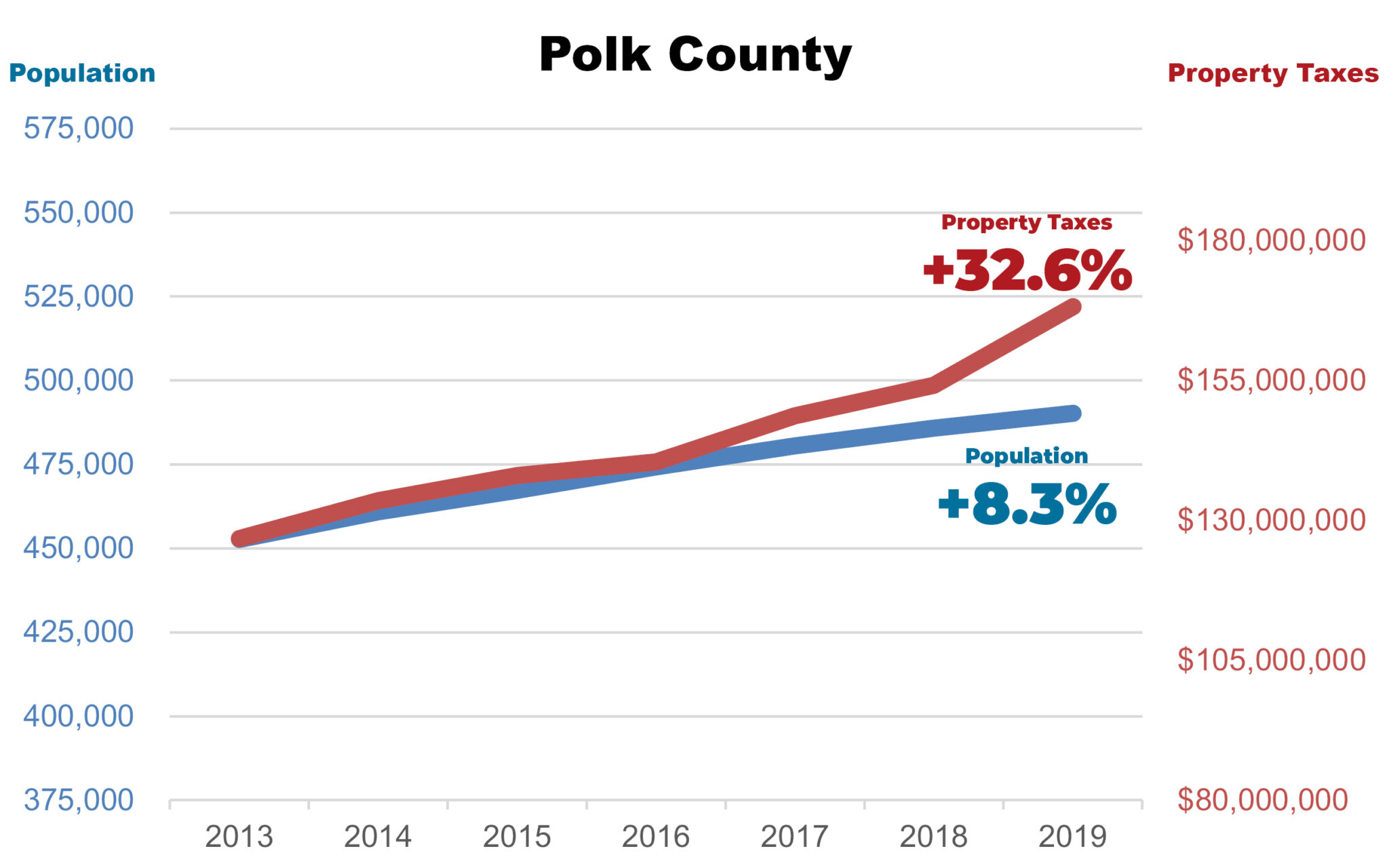

Recently, we researched property tax growth for school districts and cities across Iowa. Now, we look at counties.

When a community is growing, it needs to pay for new infrastructure. Residents might also want and be willing to pay for new parks, trails, and flood control. However, many communities are not growing or have other priorities.

In both situations, a local government’s property tax collection shouldn’t exceed population growth and inflation without voters knowing the reason for the increase.

Data for the 15 largest counties is posted on our website, and the top four are shown below. If you would like us to look up this information for your county, city, or school district, email itr@taxrelief.org.

Counties are usually the third-largest consumer of property taxes behind school districts and cities.

More than once, we have heard from ITR members their county supervisors tell them, “The county budget is on automatic pilot.” Or, “The county can’t limit spending because it is mandated by the state.”

The conversation needs to continue. The entire county budget is not set by state mandates or automatic increases. If it is, why do we need county supervisors?

When property taxes grow faster than household budgets, they:

- Force people on fixed incomes out of their homes

- Make it harder for young families to afford their first home

- Consume more and more income from renters and homeowners alike

- Allow government bureaucrats to steal choices from taxpayers on how and where to spend their money

What’s the best solution to control property taxes?

If you haven’t taken our short property tax survey yet, click the button below:

PROPERTY TAX SOLUTION SURVEY