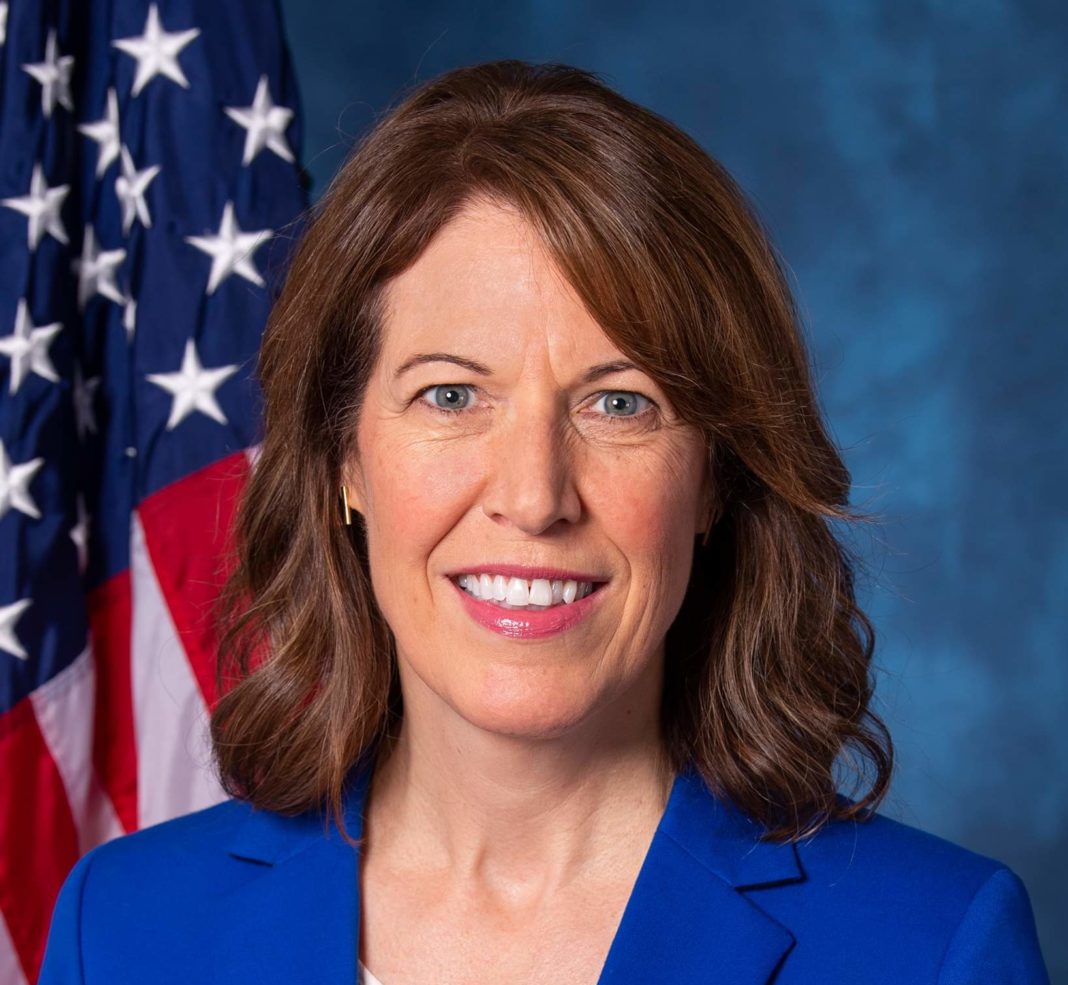

Today, Rep. Cindy Axne (IA-03) announced that she is co-sponsoring legislation to keep changes made to the Child Tax Credit (CTC) in the American Rescue Plan and make additional improvements to support millions of working families with children struggling to make ends meet.

Earlier this month, Rep. Axne and her colleagues approved an expansion of the Child Tax Credit for one year as part of the American Rescue Plan, the latest COVID-19 relief package. The legislation increased the credit to $3,000 per child, $3,600 for children under the age of 6, and make both credits fully refundable – as the previous credit was refundable only up to $1,400, leaving an estimated one-third of children in families unable to claim the full credit because of low earnings.

The American Family Act, which Rep. Axne is backing today along with over 150 of her colleagues, would make the changes in the American Rescue Plan permanent as well as index the credits to inflation.

“The temporary expansions of the Child Tax Credit that we approved in the American Rescue Plan will be a critical lifeline for American families with children that are struggling to keep food on their tables, but helping them shouldn’t be a one-year effort,” said Rep. Axne. “I’m proud to back legislation that will extend this safety net for children and their families, and put policy in place that will help drastically reduce the number of children living in poverty.”

The American Family Act would:

- Permanently raise the maximum Child Tax Credit to $250 per month ($3,000 per year, up from $2,000 per year before the American Rescue Plan) for kids 6 years of age or older for all children under the age of 18. The previous CTC only allows a credit for children under the age of 17.

- Continue the offering of the Young Child Tax Credit (YCTC) of $300 per month ($3,600 per year up from $2,000 per year) for children under 6 years of age.

- Ensure the CTC reaches “left behind” children by making the credit fully refundable.

- Index the YCTC and CTC for inflation (rounding to the nearest $60) to preserve the value of the credit moving forward, as the current CTC is not indexed for inflation.

- Continue providing the CTC on a monthly basis, ensuring benefits are provided when families and children actually need them, not in a lump sum when they file taxes.

In Iowa’s Third Congressional District, a pre-pandemic estimate projected that nearly 11 percent of children are living below the poverty line.

An analysis by Columbia University projected that the American Family Act would reduce child poverty in the U.S. from 14.8 to 9.5 percent and deep poverty (children living on half the poverty line or less) from 4.6 percent to 2.4 percent.