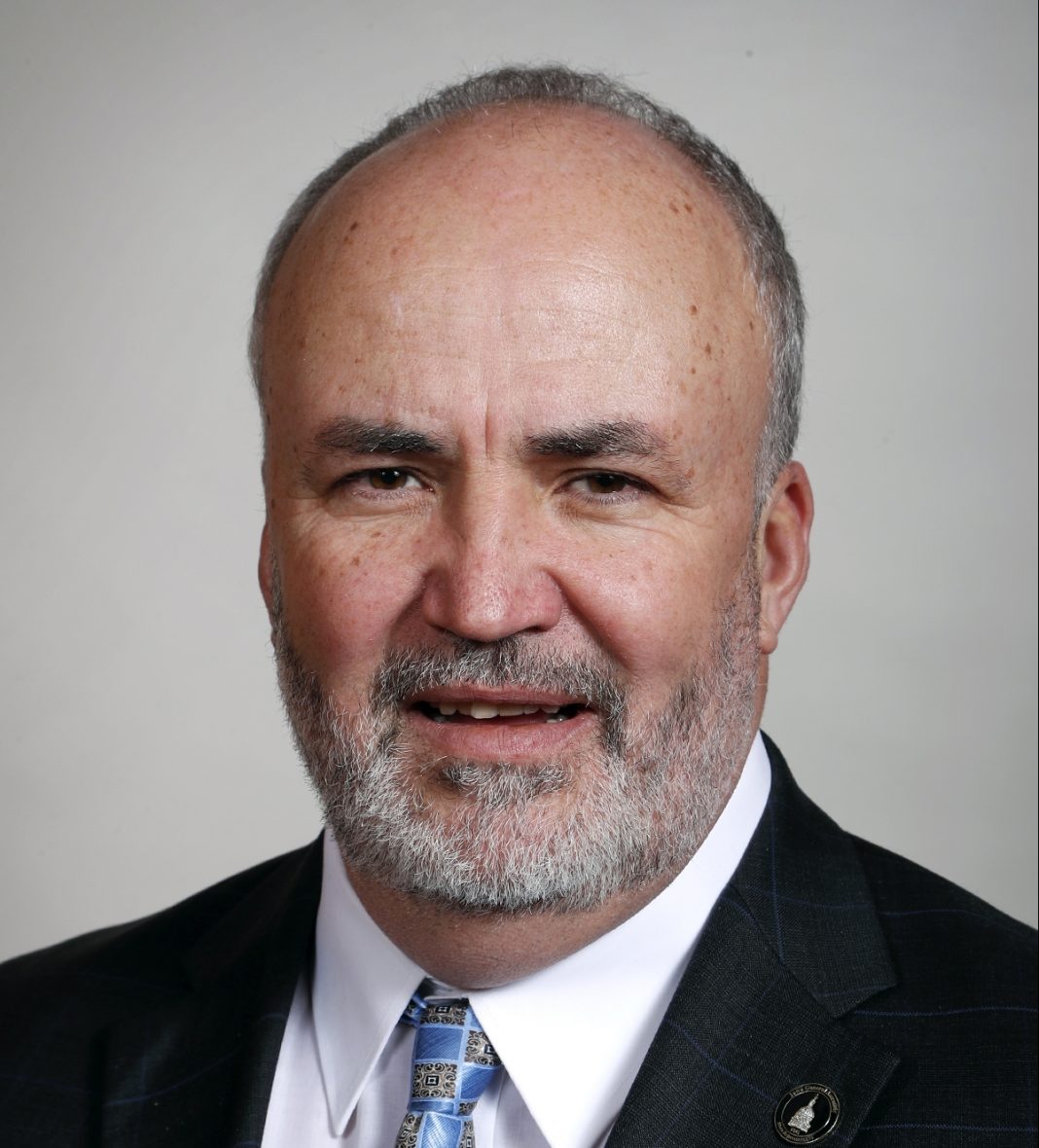

State Sen. Jim Carlin (R-Woodbury) has worked on a senior property tax freeze bill since he was elected to the Iowa House. That work has continued in the Senate.

“The premise is simple,” he said. “Seniors on fixed incomes of $30,000 a year or less will have their property taxes freeze at age 65. The income requirement may be raised to $35,000.”

It’s an issue he has seen needs addressing because of its affect on his constituents.

“The fixed income of seniors in Sioux City has really suffered a great deal from the annual increases in property taxes,” he said. “It’s anywhere from $300-$500 a year. When you’re living on $20,000 a year, that’s 4-6 percent of your income. And it happens every year. And after five years, where are you at?”

Social security does not go up at that rate, Carlin said. It creates a real hardship on those individuals.

He’s also hopeful that there will be significant income tax cuts.

“As you listen to these campaign ads on TV for the Democrat presidential hopefuls, you hear over and over again that the middle class is not being treated fairly because of powerful business interest,” he said. “Well, one of those powerful business interests happens to be federal and state government, which is consuming almost 40-50 percent of their income through federal income tax, state income tax, property tax, sales tax. And they pay corporate tax on everything they buy in the grocery store because the cost of that corporate tax is passed on to the consumer.”

All that is on top of inflation, which Carlin said is another tax.

“When you add all those things up, in many instances, you’re north of 40 percent of somebody’s income,” he said. “If you’re really earnest in your desire to help out middle class people economically, don’t take 40 or 50 percent of their income. Unfortunately, Iowa has some of the highest tax rates in the country, and we’re still phasing in Randy Feenstra’s 2018 tax bill. But if the revenues are there, let’s look at cutting them more.

“They really do need a break. If we’re going to make ourselves attractive as a state for employees, we’re going to have to lower our tax rates because people can just go on the Internet and see what’s going on. People make decisions on that basis.”

FRUSTRATED WITH FAKE NEWS? THIS IS YOUR CHANCE TO DO SOMETHING ABOUT IT!

If you are someone who believes the media refuses to give a fair shake and just report the facts, then consider supporting The Iowa Standard.

The Iowa Standard is a free online news source so we can reach as many people as possible. But we need to raise money! We are asking our readers to help support us as a news alternative entering 2020. If you could, please consider showing a sign of support to The Iowa Standard by making a contribution here. Or, you can use Venmo and make a contribution to @Iowa-Standard-2018.

You could also send a check to:

PO Box 112

Sioux Center, IA 51250