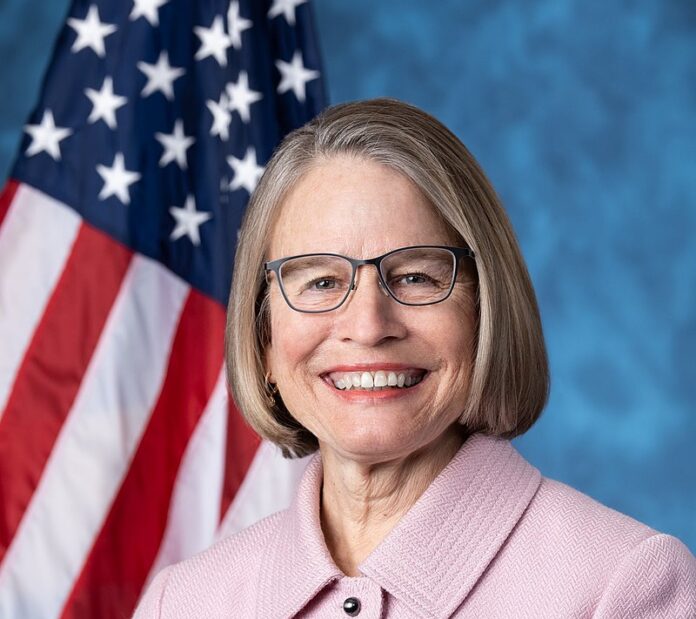

Congresswoman Mariannette Miller-Meeks (IA-01) introduced legislation that would promote access to in vitro fertilization (IVF) through a fully refundable tax credit up to $30,000. The bill seeks to provide financial relief to individuals and couples pursuing IVF expenses. Cosponsoring this legislation are Reps. Mike Lawler (NY-17) and Lori-Chavez DeRemer (OR-5).

“Every life is precious, and we have a moral imperative to support those who wish to become parents,” said Rep. Miller-Meeks. “By providing financial assistance through this refundable tax credit, we are not only making IVF more accessible but also empowering individuals and families to realize their dreams of parenthood. This bill is a commitment to supporting life and the choices of families across our nation.”

“Thousands of babies are born every year in the United States thanks to IVF. Unfortunately, it’s a very expensive procedure that often isn’t covered by insurance, which leaves it out of reach for many couples who want to have children,” said Rep. Chavez-DeRemer . “I’m proud to be an original cosponsor of this commonsense legislation, which would make IVF medical expenses more affordable – helping more Americans experience one of the greatest gifts and joys in life.”

“IVF has enabled millions to experience the joys of parenthood who would not otherwise be able,” said Rep. Lawler. “I’m proud to sign onto Congresswoman Miller-Meeks’ new bill which will ensure this life-giving procedure is accessible and affordable for families across our country.”

At the moment, the IRS permits a limited medical expense deduction for expenses relating to IVF treatments. However, the average IVF treatment cycle ranges from $15,000 to $30,000 – a significant financial burden for many Americans.

Miller-Meeks’ bill comes as recent data shows a notable rise in IVF coverage among large companies, yet a significant portion of the workforce, particularly those employed by small businesses, remains without this crucial benefit. With U.S. birth rates on the decline, the proposed legislation represents a proactive step to encourage family growth and support for those who wish to bring children into the world.

Key Provisions of the Bill:

Refundable Tax Credit: Establishes a fully refundable tax credit for IVF-related medical expenses, up to a lifetime benefit of $30,000. This means that taxpayers can receive a refund even if the credit exceeds their tax liability, making it more accessible for those with varying financial situations.

Deductibility: Allows taxpayers to deduct IVF-related expenses beyond the amount covered by the credit, ensuring that individuals and couples can maximize their financial Relief.

Eligible Expenses: Covers a broad range of IVF-related costs, including transportation to and from services, egg retrievals and transfers, counseling, lab fees, medications, and Ultrasounds.

To read the full bill text, click HERE.