Should our courts abandon 150 years of precedent and make it easier for wrongdoers to steal taxpayer funds? Fraudsters surely think so.

Employees-turned-whistleblowers of medical-device manufacturer Exactech Inc. accuse the company of selling defective knee-replacement parts to the U.S. Department of Veterans Affairs and other federal agencies, resulting in additional costly and painful operations. Now the company wants a federal judge to dismiss the case not on its merits, but on the dubious and ahistorical claim that the whistleblowers lack the authority to bring the lawsuit.

The law in question is the False Claims Act (FCA). Its qui tam provision allows whistleblowers, who possess inside knowledge of fraud schemes, to sue perpetrators on behalf of the government to recoup the lost tax dollars and share in any recoveries. Not only has this law been around for more than 150 years in one form or another; it’s become the federal government’s most effective tool to fight fraud.

The FCA’s qui tam provisions are deeply embedded in our nation’s constitutional and legal history. Known as “Lincoln’s Law,” the FCA was signed by President Lincoln to punish war profiteers who defrauded the Union Army during the Civil War. The origins of qui tam in America date back to the founding of our nation. Before the FCA became law, qui tam provisions were enacted during the First Congress by the very men who authored the Constitution.

If this provision were ruled unconstitutional, it would not only let Exactech off scot-free for allegedly supplying faulty medical devices to our veterans; it would also ignore more than a century of precedent and embolden future fraudsters to fleece taxpayers without consequence. Gutting the FCA would be a disaster for taxpayers and the Constitution.

The FCA is our nation’s primary weapon against fraud, and it has been amended by Congress and reaffirmed by the courts throughout our history. The qui tam provision has been particularly essential in our fight against fraudsters by leveraging whistleblowers’ knowledge of schemes that the government likely wouldn’t uncover on its own. These brave and patriotic whistleblowers play a critical role in protecting taxpayers, and they deserve to be rewarded for the personal and professional risks they take.

Thanks to the qui tam provisions, the FCA has helped recover more than $72 billion in grifted tax dollars, including $50 billion from qui tam cases. Just last year, qui tam cases were responsible for recovering over $1.9 billion — 86 percent of the total recovered through the FCA, which would have been lost to fraud.

Fraud is more than a drain on government funds. It’s harmful to taxpayers, it impedes the work of essential programs, and perhaps most notably, it puts lives at risk — including those in our military and law enforcement. In 2018, a Japanese manufacturing company settled allegations that it sold defective bulletproof vests to American law-enforcement and military agencies. In 2022, because of a qui tam case, a hospital system resolved allegations that it submitted false claims to federal health agencies for medically unnecessary neurosurgeries that put patients’ safety and lives at risk. In another recent case, a nursing-home chain was charged with submitting false claims to Medicare while neglecting patients.

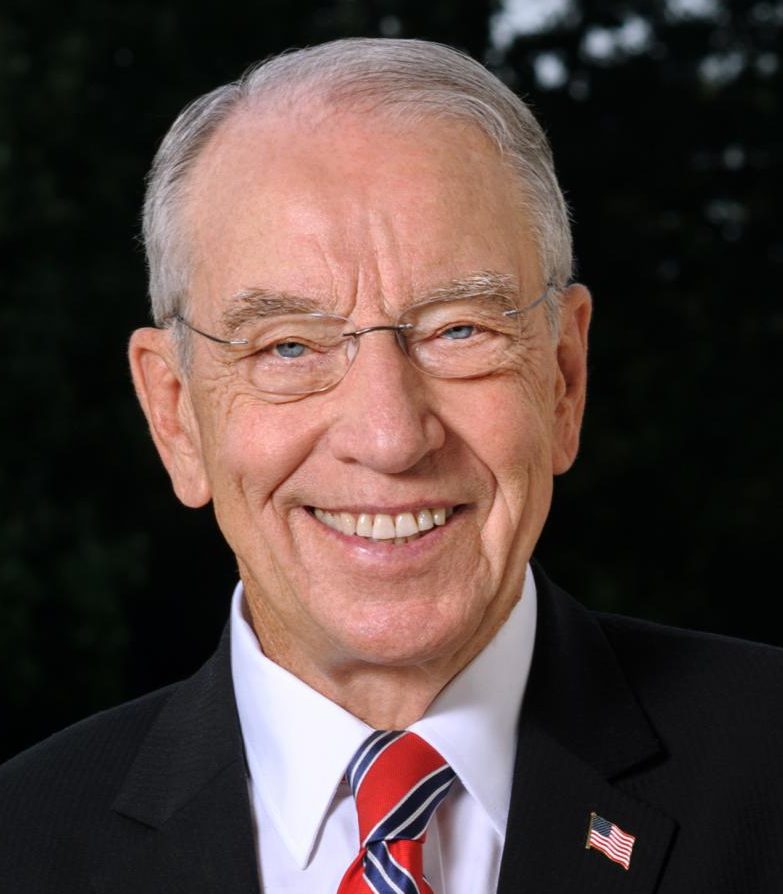

Fraud’s tremendous toll — financial and otherwise — is exactly why I’ve dedicated significant attention to strengthening and defending the FCA over the years, starting with authoring the modern FCA in 1986. The law has withstood constant legal attacks by special-interest groups looking to put profit before taxpayers, but bad actors will undoubtedly continue this crusade to keep the federal dollars flowing unchecked. The latest arguments levied by Exactech’s legal team are a perfect example.

Courts must uphold precedent over flimsy attempts to question the law’s constitutionality. Stripping the FCA of its qui tam provisions would eliminate the essential mechanism that has made the law successful — harnessing whistleblowers’ information about fraud that the government lacks. Unfortunately, there will always be bad actors looking to make a quick buck at the expense of taxpayers. There will always be nefarious and predatory businesses looking to take advantage of a crisis or a government program to enrich themselves, as we saw during the pandemic. Strong laws like the FCA deter and punish this bad conduct and encourage whistleblowers to come forward to protect taxpayers.