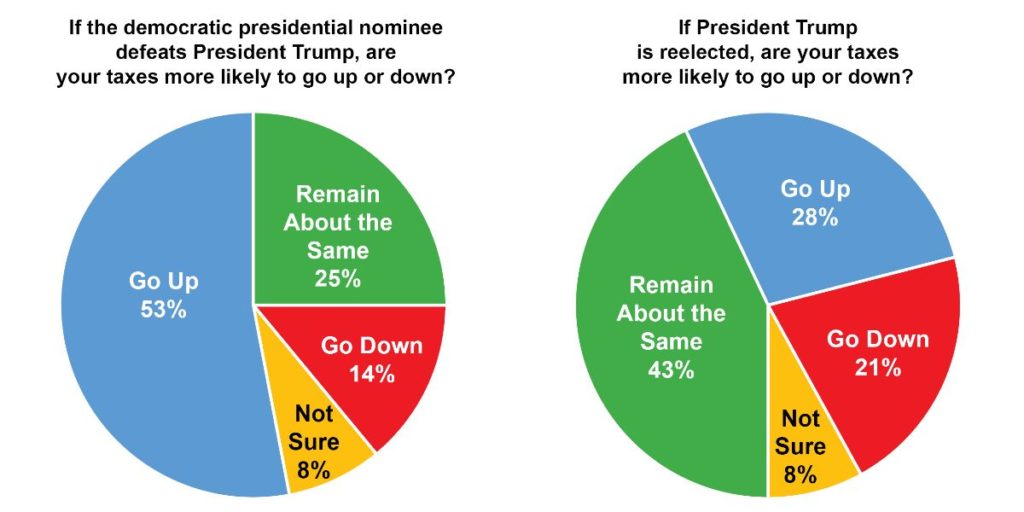

| According to a Rasmussen poll, two-thirds of likely voters say cutting taxes is a top issue for them when deciding between Trump and Biden. A closer look shows 76 percent of Republicans and 57 percent of Democrats think cutting taxes is important. When asked if taxes will increase under each candidate, voters say Biden (53 percent) is far more likely to raise taxes than Trump (28 percent). |

| Across the Country Tax policy will have a significant role to play in helping the country and Iowa recover from this crisis. Good policy decisions can strengthen the state’s economic growth for years to come. We don’t have to wonder about what might or could happen in Iowa; instead, we could look to what other states are already doing. It’s not good. Virginia Democrats plan on increasing taxes in back-to-back years.New York and New Jersey are considering a financial transaction tax as a new source of funding.California seems to always look for new taxes, including eliminating the property tax protections (assessment limits) from Prop 13. What about Iowa? When looking at the overall economic outlook for all 50 states, Iowa slipped down two spots and now ranks 27th according to Rich States, Poor States. Their index looks at 15 markers of financial stability. Some of Iowa’s impactful rankings are: |

Creating Good Tax Policy

ITR’s Five Principles of Sound Tax Policy states taxes in Iowa should be:

- Fair

- Competitive

- Transparent

- Limited

- Protective of Freedom

A tax code following these principles while reducing the tax burden on Iowans will allow everyone to keep more of their hard-earned dollars. This will encourage economic growth and boost additional investment, ultimately providing more revenue to address the priorities of state government.

Iowa’s Path Forward

Iowa’s 2018 income tax reform started a multi-year process of rate reductions, increased federal conformity, and larger deductions for small business owners, which are all good things. The largest income tax rate cut, from 8.53 percent to 6.5 percent, will not occur before 2023. It is the last scheduled change, and only when these two conditions are met:

- State revenue surpasses $8.3 billion (FY 2020 revenue was $7.55 billion)

- State revenue increases at least four percent that fiscal year

The economic hardship created by Covid-19 has made these conditions harder to achieve. How should Iowa move forward? Click the link below to take a short income tax reform survey: