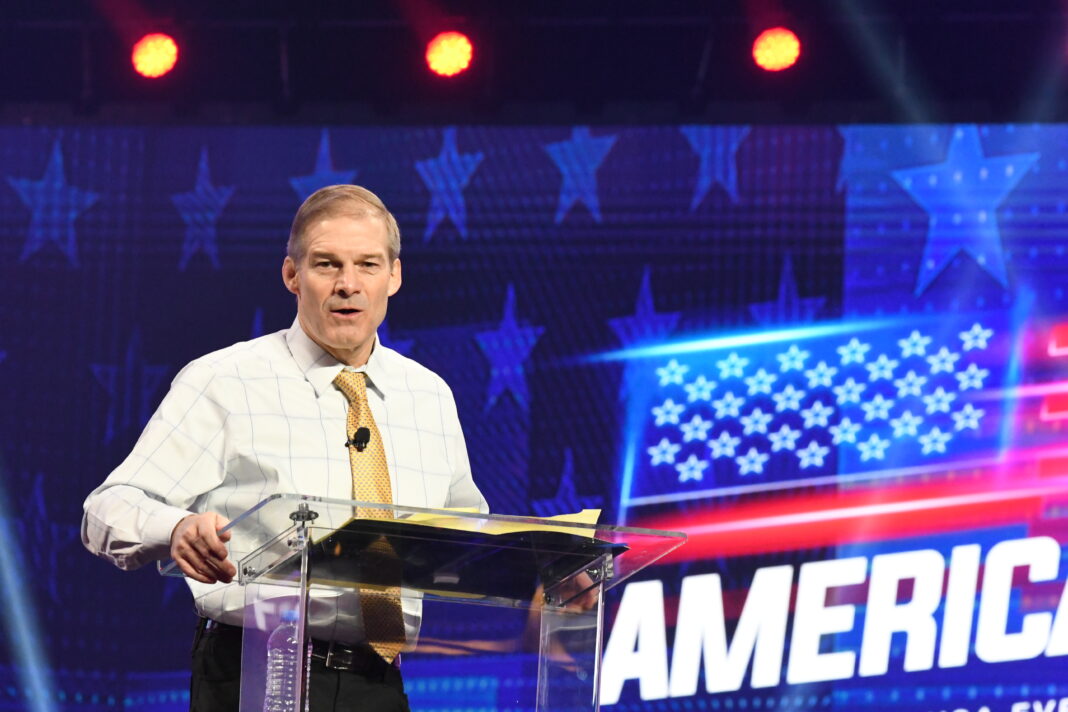

On Thursday, Chairman Jim Jordan (R-OH) subpoenaed Bank of America (BoA) for documents and communications related to the Judiciary Committee’s and Weaponization Select Subcommittee’s investigation into major banks sharing Americans’ private financial data with the Federal Bureau of Investigation (FBI) without legal process for transactions made in the Washington, D.C., area around Jan. 6, 2021.

In 2021, BoA provided the FBI—voluntarily and without any legal process—with a list of individuals who made transactions in the Washington, D.C., metropolitan area using a BoA credit or debit card between January 5 and January 7, 2021. When that information was brought to the attention of Steven Jensen, the FBI’s then-Section Chief of the Domestic Terrorism Operations Section, he acted to “pull” the BoA information from FBI systems because “the leads lacked allegations of federal criminal conduct.” Documents obtained by the Committee and Select Subcommittee show that the FBI also provided BoA with specific search query terms, indicating that the FBI was “interested in all financial relationships” of BoA customers transacting in Washington D.C. and that had made “ANY historical purchase” of a firearm, or those who had purchased a hotel, Airbnb, or airline travel within a given date range.

In its June 22, 2023, letter to the Committee, BoA asserted that its actions “were within a legal process initiated by the United States Department of the Treasury.” Contrary to these assertions, however, documents on file with the Committee and Select Subcommittee indicate that the FBI—not the U.S. Department of the Treasury—initiated contact directly to BoA, and without legal process. As a result, it is unclear what “legal” process permits the FBI or BoA to share the sensitive customer information of potentially thousands of BoA customers and implicate them in a federal law enforcement investigation without any clear criminal nexus. To that end, BoA’s letter claimed that certain federal laws—namely, the Anti-Money Laundering Act and the Bank Secrecy Act—permit such an arrangement. However, these laws and corresponding regulations primarily contemplate information-sharing with the U.S. Department of Treasury and its components, not external correspondence with the FBI.

If such a lawful authority exists, as BoA asserts, for BoA to freely share private

financial information without any legal process or specific nexus to criminality, Congress has a responsibility to consider reforms that adequately protect Americans’ information. It should not be the case that federal law enforcement has carte blanche access to Americans’ financial information by deeming a transaction or class of transactions as “suspicious” or otherwise. For that reason, to inform such legislation, it is critical that the Committee understand the full extent of the information-sharing between BoA and the FBI, including review of BoA’s “filing” that it emailed to the FBI.

The Committee and Select Subcommittee are authorized to conduct oversight of matters involving civil liberties and criminal law to inform potential legislative reforms, and to date, BoA has failed to comply with the Committee’s request voluntarily.

Read the subpoena cover letter to Bank of America here.