Reducing the tax burden on hard working Iowan’s is a top priority for Republicans in this state. We have proven this by cutting Iowans income taxes multiple time over the past 5 years while also reducing their property taxes. This week the Iowa House was able to fulfill a long-held promise to reduce income taxes even further. HF 2317 is a historic piece of tax reform legislation, and it passed with bi-partisan support after a lively debate on the House floor. This bill has three key pieces of tax relief that impact all Iowa taxpayers:

- It gradually reduces the individual income tax to a flat tax of 4%. A flat tax brings parity and equality to all hard-working Iowan’s. The basic premise being, the more you work the more you keep.

- It exempts retirement income from income taxes, providing relief and certainty to a population who deserves a break after decades of hard work.

- It includes a new income exemption for retired farmers, who will be able to keep more money in their pockets after years of giving back to the state through their agriculture service.

This important and monumental piece of legislation is possible thanks to the Governor’s leadership and House Republicans’ conservative budgeting practices. After years of Republican leadership passing budgets that do not spend more then the state takes in, Iowa’s ending balance remains strong. Strong enough to fulfill our commitments to the taxpayers by returning their money from the Taxpayer Relief Fund, which has reached over $1 billion.

The second piece of our tax plan, that makes all retirement income tax free, is vital to making Iowa a competitive place for individuals to live, work, and raise a family. How retirement income is taxed in each state can have a monumental impact on where folks choose to retire and make their primary state of residence. We often see Iowan’s move out of state after they retire to places that have a more advantageous tax code. If we can keep those pillars of our communities here, who have given so much to our state, that means they will continue to contribute to the state economy and in their local communities.

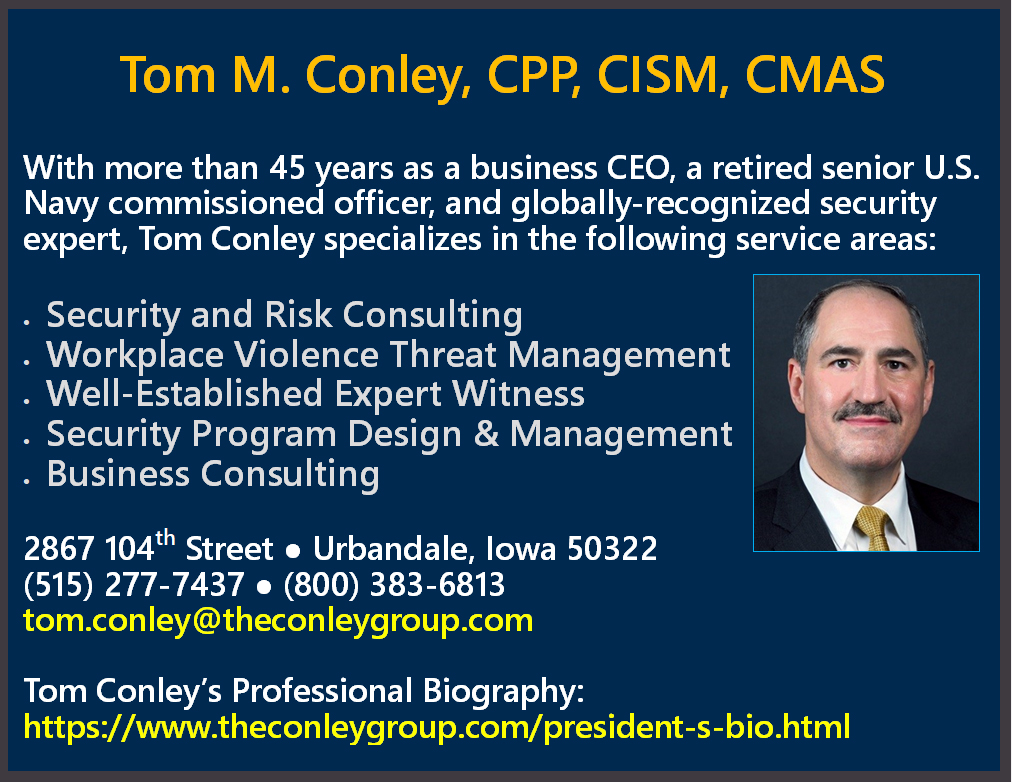

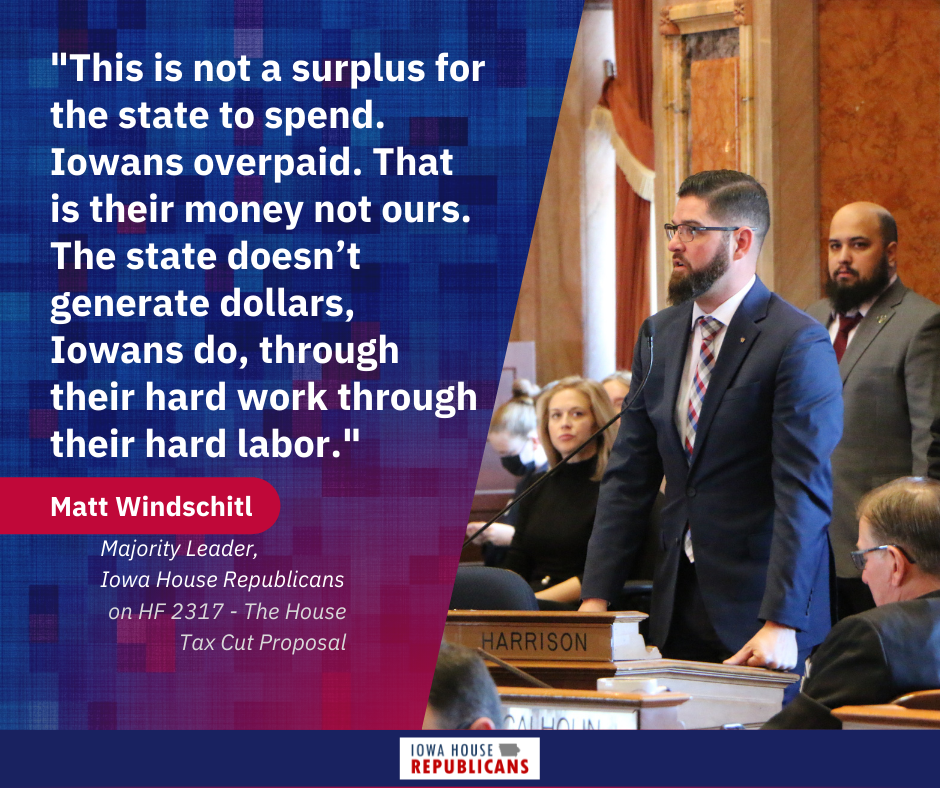

The bottom line is that the state of Iowa is taking in more money than it needs, which is an overpayment by the taxpayers, and House Republicans fundamentally believe that we need to return this overpayment to Iowans. I took a moment to speak during this debate on the House Floor because I feel passionately about how important this tax reduction is. You can watch my full comments on the bill in the video below, but I believe the following graphic best represents my overall feelings in regards to HF 2317:

The bill now goes to the Senate where negotiations will continue between the House, Senate and Governor to finalize this historic tax reduction.