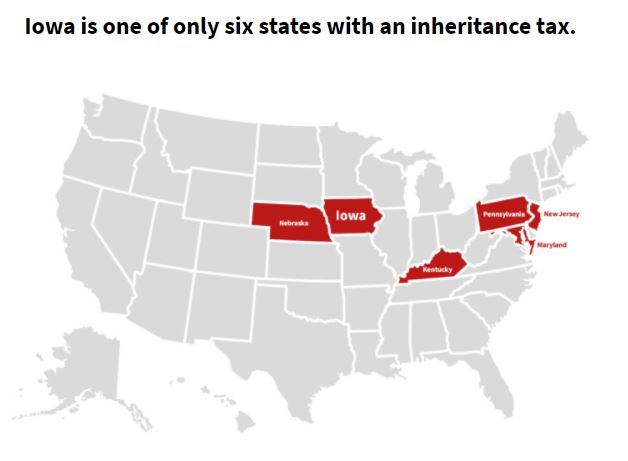

Iowa is one of only six states with an inheritance tax. But if the Iowa Senate has its way, the inheritance tax will soon expire in the Hawkeye State.

Senate Study Bill 1026 sailed through a Tuesday subcommittee hearing.

While spouses, children and parents are excluded from the inheritance tax in Iowa, nieces and nephews, siblings and business partners all have to pay taxes on inheritance if the total estate value exceeds $25,000.

Iowans for Tax Relief says government shouldn’t tax some people, but not others in the same circumstance.

The solution? Completely eliminate the inheritance tax for everyone.

And most of those who testified Tuesday were in agreement.

Victoria Sinclair of Iowans for Tax Relief said that Iowa is a great place to live and raise a family, but not a great place to die.

“When people inherit assets like land or a small business, they could potentially be forced to sell off pieces of the land or of the business in order to pay the taxes on it,” she said. “Which is the opposite effect that good tax policy should have.”

Drew Klein of Americans For Prosperity – Iowa said that Iowa’s estate tax is “offensive.”

“It unequally affects individuals who chose not to or couldn’t have children of their own,” he said. “After a life of working, saving and paying taxes, there’s no justification for the state to tax individuals and the fruit of their life’s work simply because they’ve died.”

NFIB has more than 10,000 members in Iowa. Matt Everson said the organization is supportive of eliminating the inheritance tax.

“Year after year our members rate this as one of their top priorities,” he said. “As we all know, most small businesses are asset heavy but cash poor. A small business owner should have the right to pass their business down to anyone willing to keep the business and the jobs that go along with the business open without a massive tax bill attached to it.

“Now is the time to finally get rid of this small business-killing tax.”

Democrat State Sen. Janet Petersen said she was content with the bill, though she asked for the bill to go into effect upon enactment rather than to wait until July 1.

Petersen asked Republican Senator Dan Dawson, who chaired the subcommittee, if he’s comfortable with the $30 million fiscal note for the first year and $86 million fiscal note for the following year.

“Absolutely,” he said.

Senator Annette Sweeney said the inheritance law right now doesn’t allow people who hire others to gift their land to them upon death the ability to start their operation right away due to the tax bill associated with the asset transfer. She said she has friends who inherited “a piece of ground” that they’re still paying for because of the inheritance tax.

“I think the inheritance tax is a direct business killer no matter if it’s agriculture or small businesses,” Sweeney said. “It is just not favorable.”

Dawson offered enthusiastic support of the bill.

“This is something that has been a priority for us for a few years, and we’re hoping this is the year to get it across the finish line,” he said.

If you’re curious, the other states with an inheritance tax include Nebraska, Kentucky, Pennsylvania, New Jersey and Maryland.