If you were to fill out a tournament bracket based on each state’s taxes, few people would pick the State of Iowa to advance past the first round.

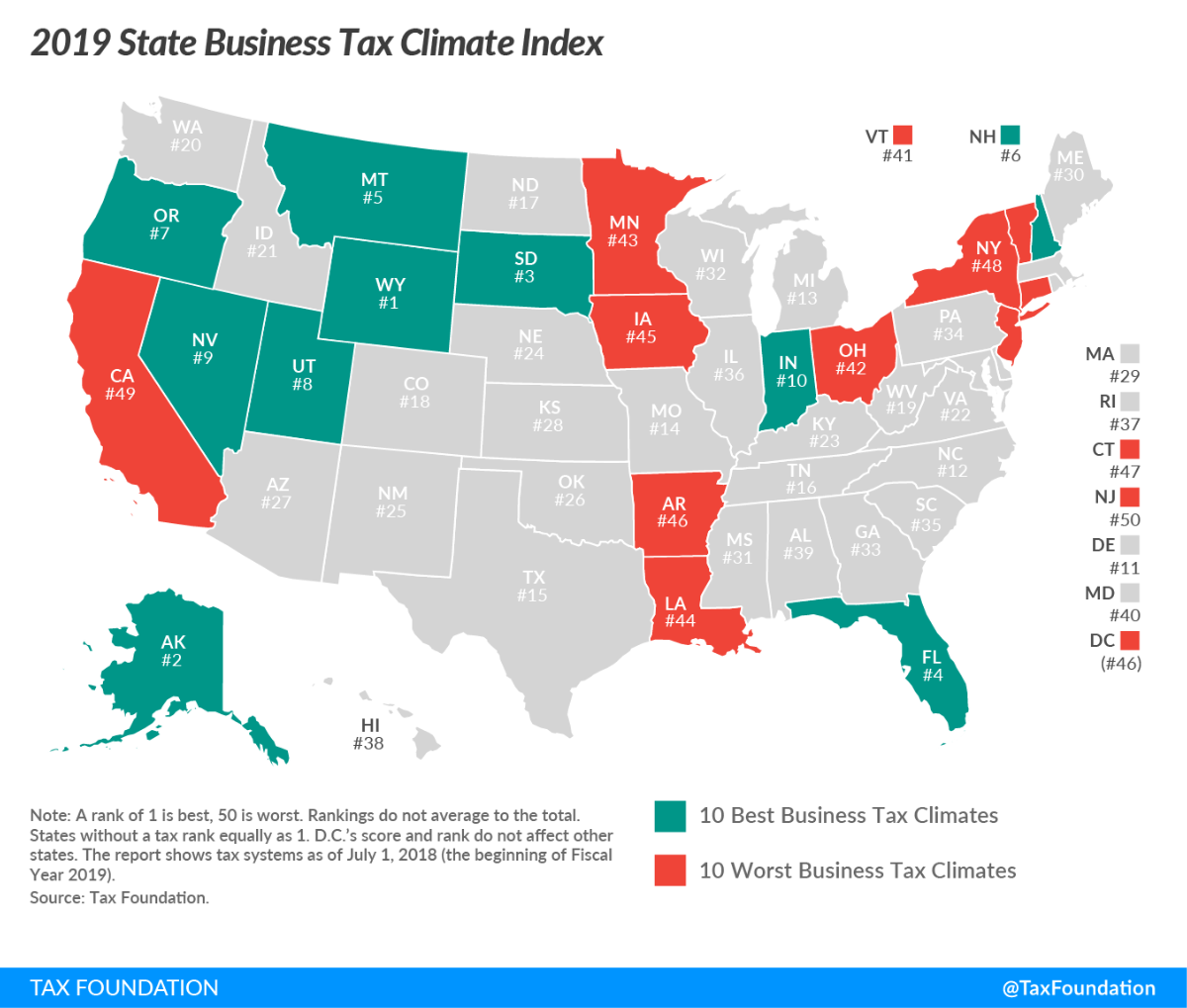

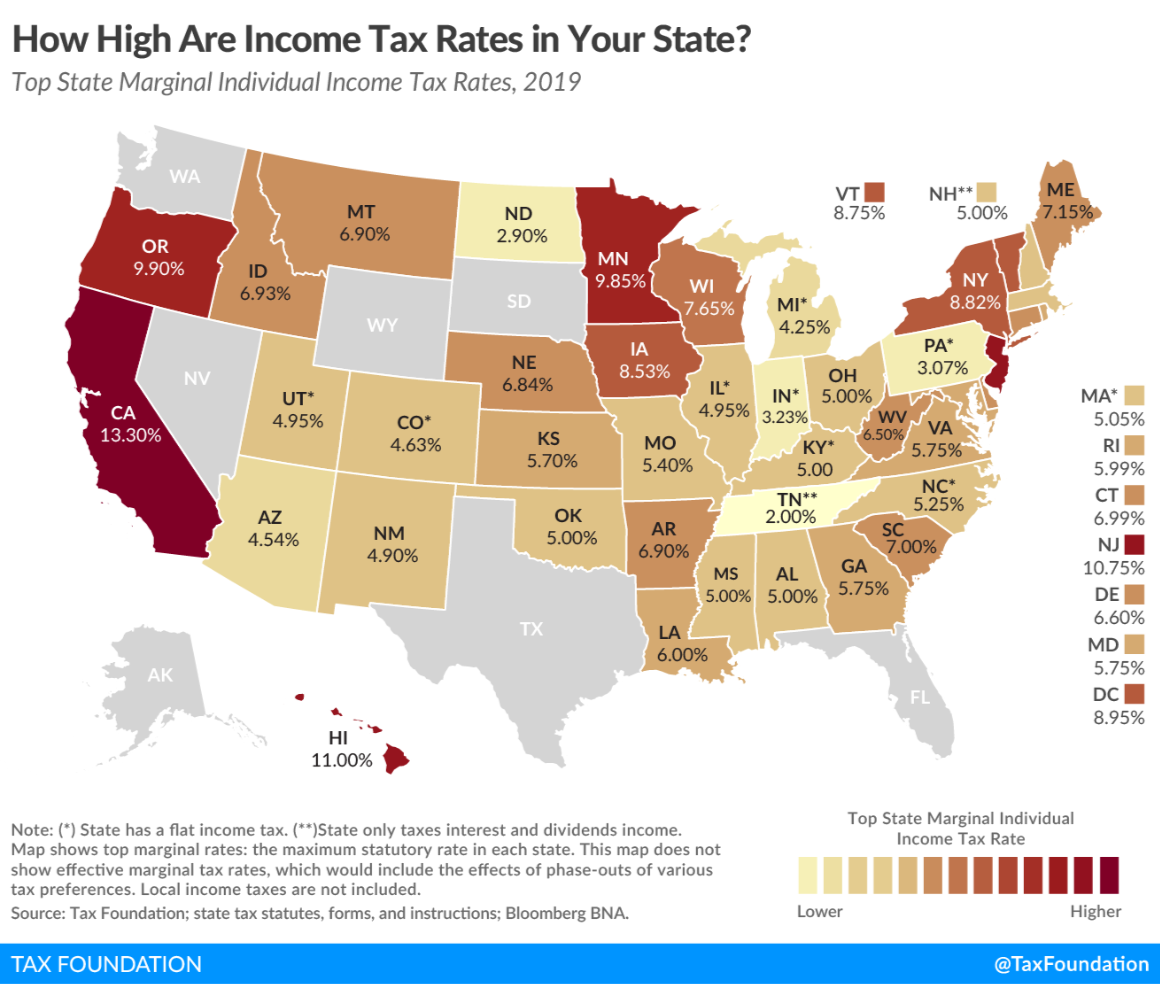

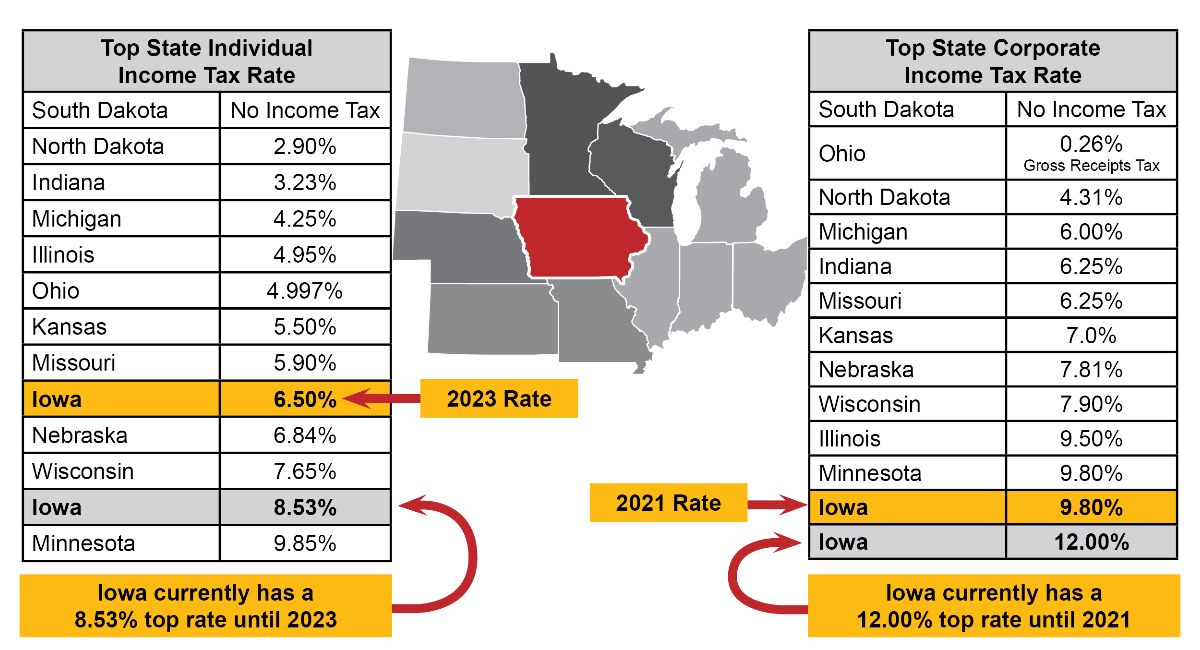

According to the Tax Foundation, Iowa has the sixth worst state business tax climate and the ninth highest individual income tax rate.

High tax rates deter economic growth and productivity. High tax rates also provide a competitive disadvantage as states race to attract and retain residents and businesses. Individuals, entrepreneurs, and businesses will vote with their feet by moving to states with the best regulatory and tax climates.

The Tax Foundation article cites the National Movers Study comparing the number of inbound and outbound moves for each state. Again, Iowa’s ranking is near the bottom at 42 out of 50.

While last year’s tax reform is a good start, Iowa’s tax rates remain some of the highest in the nation. Iowans need to feel confident they can succeed with hard work and ingenuity. Creating a better tax climate will impact Iowa for generations.