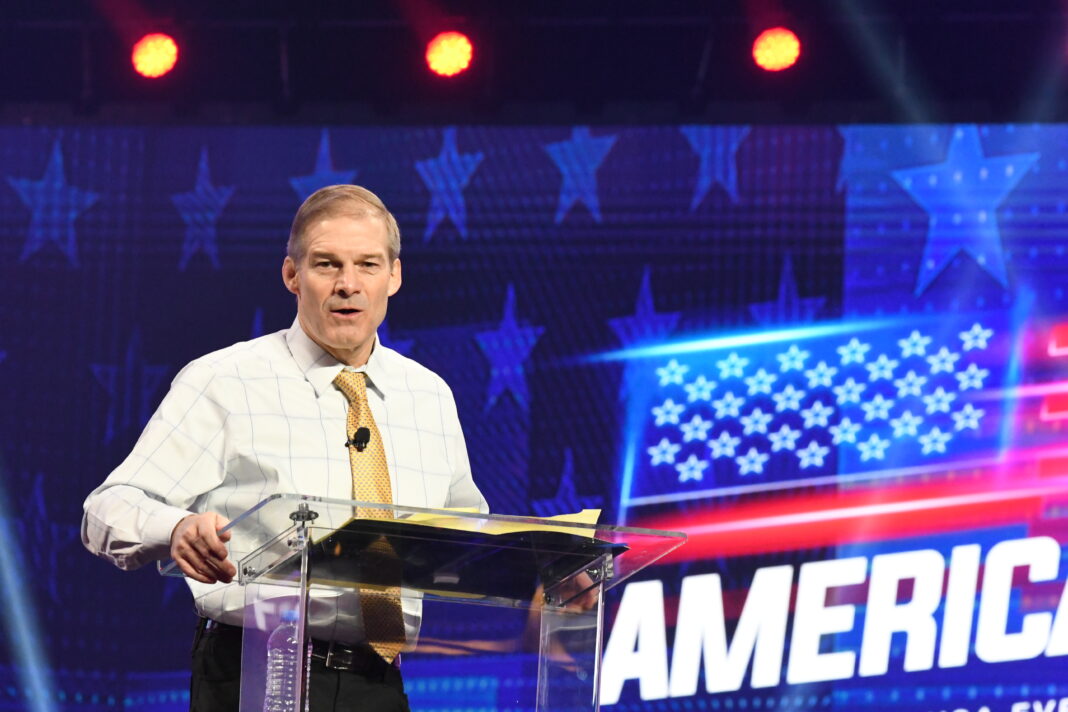

Today, House Judiciary Committee Chairman Jim Jordan (R-OH) sent a letter to Nicole Argentierti, Acting Assistant Attorney General of the Department of Justice (DOJ) Criminal Division, opening an inquiry into the DOJ’s unusual and questionable leniency towards Charles Littlejohn, an IRS contractor who leaked tax information belonging to over 7,600 Americans, including President Donald Trump, Elon Musk, Jeff Bezos, and Senator Rick Scott (R-FL).

The DOJ’s decision to pursue just one charge for thousands of separate criminal acts is highly concerning, and the Committee worries that the DOJ’s decision may be politically motivated.

Excerpts from the letter to Nicole Argentieri:

“The Committee is conducting oversight of the Department of Justice’s enforcement of federal law. Recently, the Department allowed a defendant, Charles Littlejohn, to plead guilty to only one count of unauthorized disclosure of tax information even though he admitted to leaking ‘thousands of individuals’ and entities’ tax returns’ to ProPublica and the New York Times. The Department’s decision to pursue just one charge for ‘thousands’ of separate criminal acts is highly concerning, and we worry that the Department’s decision may be politically motivated.

“The details of Mr. Littlejohn’s criminal activity are shocking. As the Department’s filings state, Mr. Littlejohn applied to work at Booz Allen in 2017 with the intention of working as a consultant to the Internal Revenue Service (IRS) to access and disclose then-President Donald Trump’s tax returns. Mr. Littlejohn successfully did so and further leaked tax information belonging to over 7,600 other Americans, including Elon Musk, Jeff Bezos, and Senator Rick Scott. As the Department stated:

“The scope and scale of Defendant’s unlawful disclosures appear to be unparalleled in the IRS’s history. There simply is no precedent for a case involving the disclosure of tax return and return information associated with ‘over a thousand’ individuals and entities. . . . the human impact of Defendant’s crimes is enormous.

“The Department nevertheless chose to charge Mr. Littlejohn with just one count of unauthorized disclosure of tax information, resulting in a 5-year prison sentence, three years supervised release, and a $5,000 fine During Mr. Littlejohn’s sentencing hearing, Judge Ana Reyes called Mr. Littlejohn’s disclosure of President Trump’s tax returns an ‘attack on our constitutional democracy.’ She admonished the Department’s plea deal, saying, ‘The fact that he is facing one felony count, I have no words for.’

“The Committee must understand the Department’s unusual and questionable leniency towards Mr. Littlejohn. Accordingly, to inform our ongoing oversight of the Department, please provide the following information:

1. All documents and communications between or among employees of the Department of Justice referring or relating to the charging decisions in United States v. Charles E. Littlejohn;

2. All documents and communications between employees of the Department of Justice and the Internal Revenue Service referring or relating to the charging decisions in United States v. Charles E. Littlejohn.”

Read the full letter to Nicole Argentieri here.