Americans spend a lot of time thinking about and planning for retirement. Working-aged Americans consider how much money is needed to save in order to live comfortably in their golden years. Workplace retirement savings accounts are a smart way to plan ahead and have been very successful in helping employees to save for retirement. However, not all workers have access to a retirement plan and some workers who have access don’t always participate.

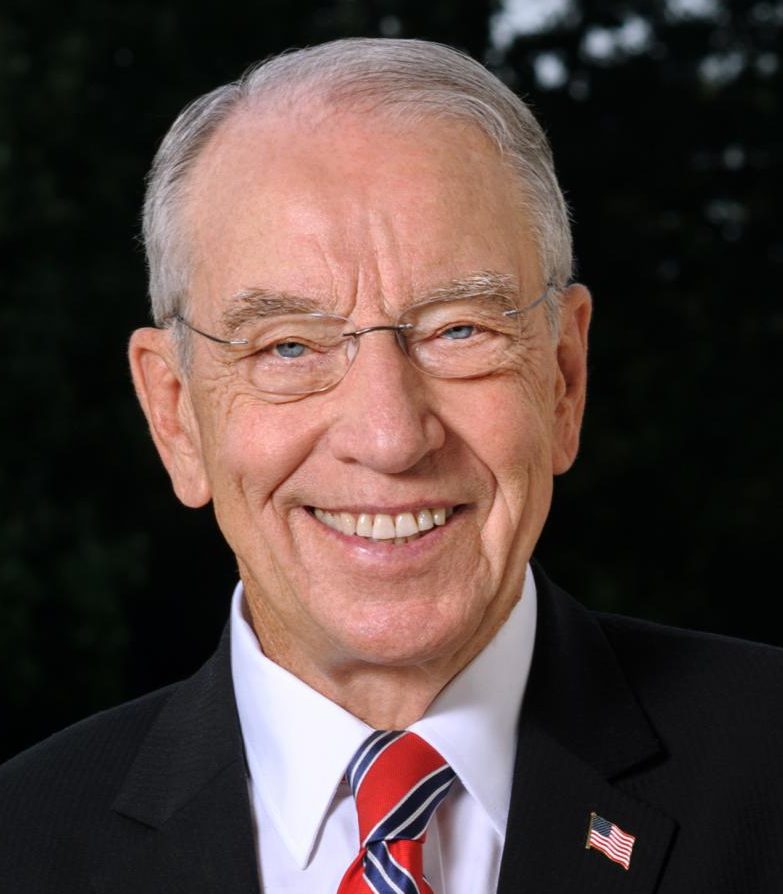

Congress can and should do more to encourage and facilitate retirement savings. That’s why earlier this year, along with my Democratic colleague Senator Ron Wyden, I introduced the bipartisan Retirement Enhancement and Savings Act (RESA) of 2019. This legislation provides new incentives for employers to adopt retirement plans while helping to reduce the costs of operating them. It also creates new provisions to encourage workers to plan and save for retirement.

This bill has been a long time in the making. Work on it began in 2006, and over several years the Senate Finance Committee has held hearings on the retirement system and reviewed various proposals to improve it. The best ideas were included in the RESA bill, which was unanimously approved by the Finance Committee in 2016.

This legislation would reform America’s retirement savings laws in a number of important ways. For example, it would improve an existing type of plan called a multiple-employer plan. The bill would expand such plans so that employers can join together to sponsor a single retirement plan for their workers. Open multiple-employer plans would make it far more feasible for businesses of all sizes, especially small businesses, to offer retirement plans by reducing unnecessary administrative burdens on employers. More importantly, they would open the door for millions of Americans to save for retirement.

According to the U.S. Small Business Administration, Iowa is home to more than 260,000 small businesses that employ nearly 650,000 workers. This bill includes provisions designed to make it easier and more cost-effective for our smaller employers to sponsor a retirement plan. Small businesses and farms are vital to our economy. We need to encourage a level playing field so that workers at small businesses throughout the country have equal access to retirement plans just like workers at Fortune 500 companies.

RESA would create a new fiduciary “safe harbor” for employers that allow employees to invest in lifetime-income arrangements like annuities. That would expand the portability of retirement plan assets, including annuities, allowing workers to keep their retirement savings when they change jobs throughout their careers.

Another important benefit of this legislation is that it would help employees add to their retirement savings each year through automatic increases in contributions to 401(k) plans. And, to help workers plan better for life in retirement, it would require employers to provide an estimate of how much the employee’s account would provide during retirement if the employee invested the balance in an annuity.

All of this is intended to help individuals get on the path of saving for a secure retirement during their working years. But it is also with an eye toward making sure their savings will last once they retire.

Retirement security is an important topic, not only for those nearing retirement age, but also for young people just beginning their careers. Increasing long-term savings in America is critical to the individual and collective success of our country. We know there are ways that Congress can improve our private retirement system further to make it easier for Americans to save. The reforms in the Retirement Enhancement and Savings Act are an important step forward in improving Americans’ retirement security.