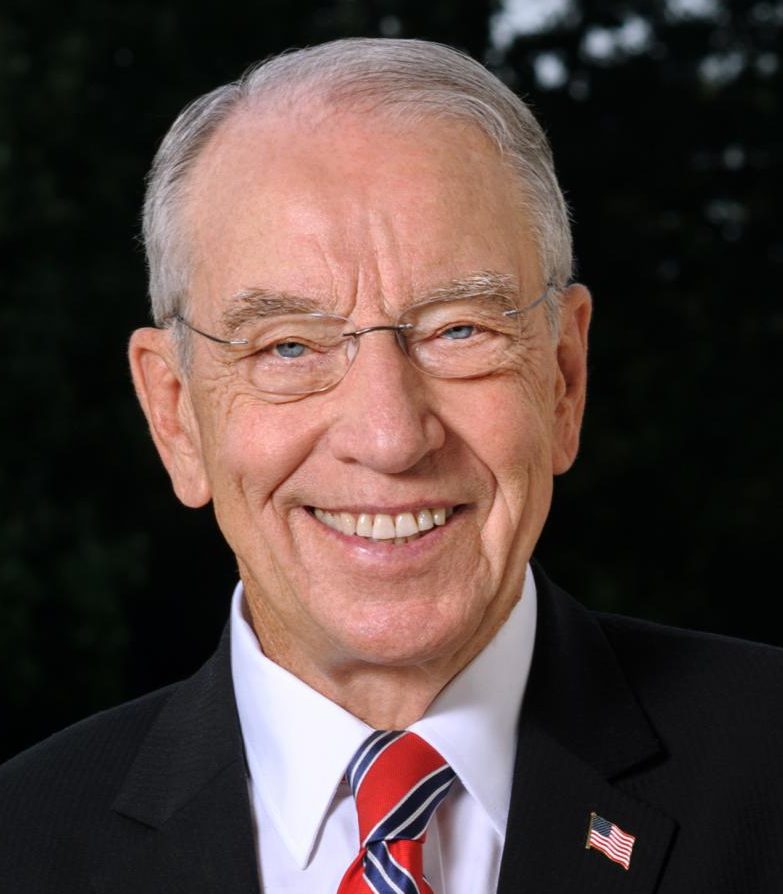

One year after President Biden signed into law Democrats’ Inflation Reduction Act (IRA), U.S. Senate Budget Committee Ranking Member Chuck Grassley (R-Iowa) today issued the following statement:

“The most effective policymaking happens when legislators of different political ideologies work together on behalf of the American people. When congressional Democrats unilaterally moved a historically massive spending package through the legislative process last year – despite persistent pushback from their Republican colleagues – they and President Biden did Americans a disservice.

“Democrats named that package the ‘Inflation Reduction Act;’ I call it the ‘Inflation Enhancement Act.’ What matters is not the name, but how the bill impacts people. One year into implementation of the Inflation Enhancement Act, the consequences are real and painful: Iowans are paying more now to put food on the table and keep a roof over their heads.”

The IRA passed both chambers of Congress last year without a single Republican vote; in the Senate, it required a tie-breaking vote by the vice president.

Effects of the Inflation Enhancement Act

The Congressional Budget Office, the non-partisan agency that reports to Congress on the economic impact of federal budget decisions, in February cited the IRA as a contributor to “upward pressure on the prices of goods and services, causing inflation to be higher than it would be otherwise.” Among other market factors, the IRA is squeezing Iowans’ pocketbooks:

- The price of gas in the Des Moines area is up roughly 14 percent from this time last year.

- Housing costs and mortgage rates increased nationwide by approximately seven and two percent respectively. Moreover, interest rates have climbed to a 22-year high, putting the dream of homeownership out of reach for more and more Americans.

- Grocery prices rose 4.9 percent in the last 12 months.

President Biden last week lamented Democrats’ decision to name the bill the “Inflation Reduction Act,” admitting it “has less to do with reducing inflation than it does to do with dealing with providing for alternatives that generate economic growth.” The IRA incentivizes those alternatives through green tax credits and subsidies that cost taxpayers, add hundreds of billions of dollars to the national debt, weaken American energy independence and do nothing to save families money on energy bills.

- IRA electric vehicle (EV) tax credits will further drive U.S. reliance on China, which dominates over 70 percent of global EV battery cell production capacity.

- IRA green credits are expected to primarily benefit rich families. By 2031, those earning below $500,000 are projected to bear as much as two-thirds of the burden of the tax hikes included in the bill.

- Even with billions of dollars in IRA subsidies for green energy companies, permitting delays continue to prevent the construction of renewable and fossil fuel energy projects.