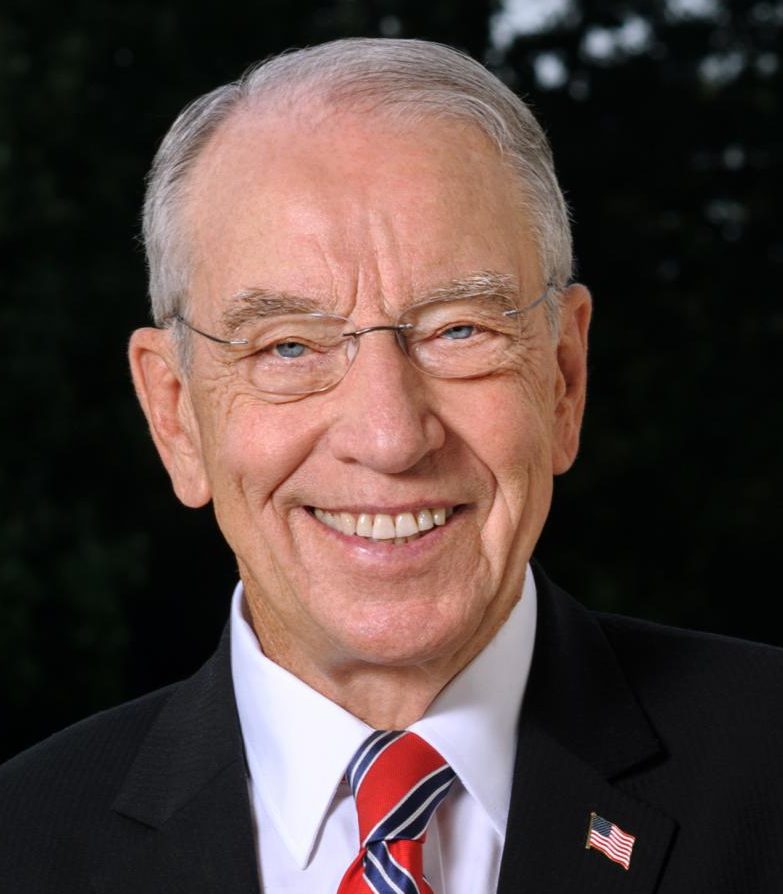

Q: What’s up with the proposal that would require banks to report account holder information to the IRS?

A: The Biden administration is searching under every couch cushion in America to pay for its reckless multi-trillion dollar spending spree. I’ve got news for the big spenders. Nickle and diming America’s wage earners and retirees won’t pay for the $4.2 trillion package they want to ram down the throats of the taxpaying public and saddle our kids and grandkids with massive debt for generations to come. One of their biggest talking points is the need for Americans to pay their “fair share.” Translation: The middle class needs to grab their wallets. One of the boneheaded proposals being pushed by the administration is new reporting requirements on community banks and financial institutions. It would give the IRS access to financial transactions of nearly every individual with a bank account. Not only is this an assault on individual privacy, it would create expensive and burdensome requirements on Main Street lenders. I’ve called on the Biden administration to pull the plug on this unprecedented proposal. Expanding the federal government’s sticky fingers into tracking routine inflows and outflows of law-abiding taxpayer’s bank accounts is a massive intrusion into the financial affairs of Americans.

The administration continues to make false claims that it won’t raise taxes for Americans who earn more than $400,000 a year. That’s pure poppycock. According to an analysis by Congress’ official tax scorekeeper, there isn’t a single income group entirely spared from Democrat’s tax hikes. The tax bill being written in the House of Representatives would raise marginal tax rates on individuals and small businesses to levels not seen in 35 years. Jacking up the corporate tax rate would undo the economic good we accomplished with the Tax Cuts and Jobs Act of 2017. It’s a tale as old as time. When you tax something, you get less of it. Raising taxes would roll back our economic recovery, slow wage growth and compel corporations to flee overseas for a more competitive climate. Why is the Biden administration and Congressional Democrats obsessed with raising taxes and endless borrowing? Their reckless agenda would transform our economy and replace freedom with socialism. Slashing the estate tax exemption and repealing stepped up basis would be the death knell to family farms and family owned small businesses. Their tax and spending plan picks winners and losers, creating massive entitlement programs that would undermine the fiscal health of Social Security and Medicare. Iowans deserve better. President Biden is demanding Congress write blank checks for more spending and more borrowing. His claim that the multi-trillion budget has a “zero price tag” on the debt is as reckless and irresponsible as the spending package.

Q: Why is it critical for the Department of Justice to get to the bottom of the IRS data breach?

A: As a longtime taxpayer watchdog, I’ve written several laws aimed at improving customer service at the federal tax-collecting agency and beefing up the Taxpayer Advocate Service. It’s awfully ironic the Biden administration is calling for new bank reporting requirements when the IRS can’t keep its own house in order. Recall that during the Obama administration, the IRS targeted conservative social welfare organizations. Now, during the Biden administration, the IRS has experienced what is perhaps the worst breach of data in its history. Congress passed strict criminal penalties, including in 1976, for the unauthorized disclosure of confidential tax information. These laws not only protect individual privacy, they are a crucial check on the power of federal taxation for warped political purposes. Watergate-era protections were designed to prevent one’s tax information from becoming weaponized against taxpayers. Fast forward 45 years, a nonprofit news outlet ProPublica began publishing stories based on a “vast trove of Internal Revenue Service data.” Just as Congress forewarned more than four decades ago, the release of confidential taxpayer information is a massive violation of the privacy of taxpayers who are attempting to comply with the tax law. The release is a criminal violation of federal law. Even worse, it will have a chilling effect on ordinary Americans who are asked to hand over personal information to the IRS. A federal income tax return contains some of the most sensitive information there is about our fellow Americans. It is essentially a blueprint for how families and individuals live their lives. Aside from detailing where and how taxpayers support themselves and earn money, tax returns potentially detail what charities, including religious institutions, a taxpayer supports. They can also detail where and how they take care of their children, their medical status, and lots of other deeply personal information. Taxpayers now have legitimate reason to fear their information may become weaponized by activists pushing their own agenda. In this age of rising cybercrimes, it is mission critical for the federal government to enforce criminal penalties and protect the integrity of the IRS. I’ve called upon the Department of Justice and the FBI to do their jobs and find those responsible for these disclosures and to punish them according to the law. Failure to do so erodes faith in our system of voluntary tax compliance. Congress should have no appetite to pass expansive new reporting requirements and give the IRS free rein over the bank accounts of law-abiding American citizens.