Q: Is there a plan in Congress to defund Social Security?

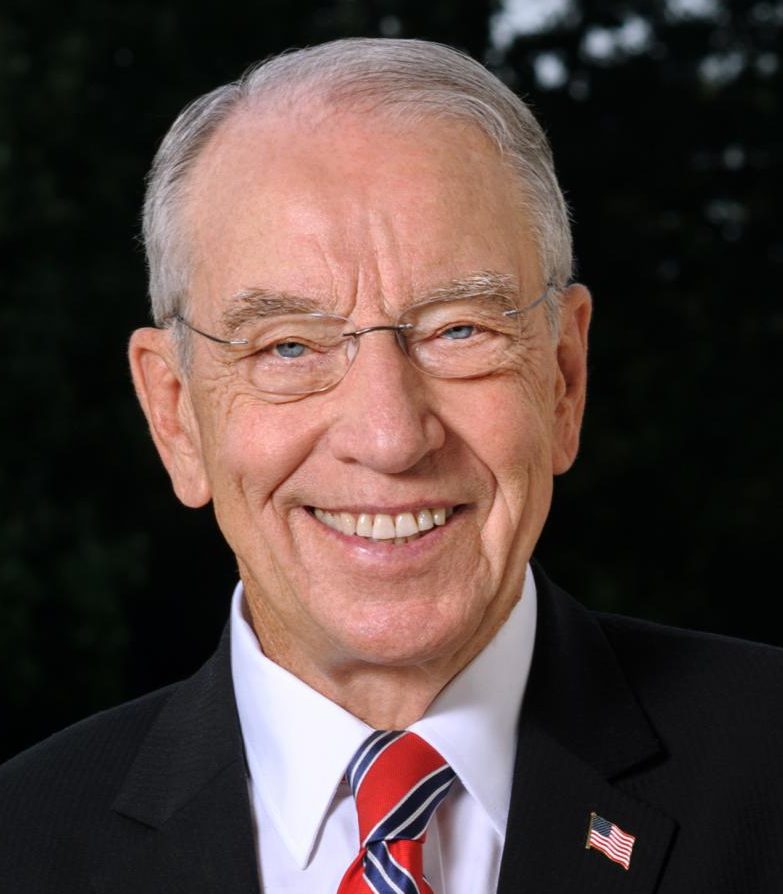

A: No. Every few years, almost like clockwork, there are claims that there are serious proposals to destroy the Social Security program that so many of our seniors and workers on disability have invested in and depend on to make ends meet. This year is no exception. Let me set the record straight. No legislation whatsoever exists to eliminate payroll taxes or defund Social Security. Any attempt to distort the truth to manipulate and scare seniors and American workers on disability is wrong. Thankfully, Iowans are an astute electorate who carry forward a strong legacy of civic engagement and informed views, so I don’t expect that Iowans will be taken in by tactics like these. The reality is there is a strong commitment on both sides of the aisle – among Republicans and Democrats alike – to keep the Social Security program intact and on sound financial footing. When it comes to Social Security, I will always work to uphold the social contract that guarantees hard-earned benefits to seniors for generations to come.

Q: What is the solvency status of the Social Security trust funds?

A: According to the most recent annual report released in April, the nonpartisan Social Security Board of Trustees calculated the Old-Age and Survivors Insurance (OASI) and Disability Insurance (DI) trust funds had a surplus of $2.5 billion in 2019, ending with $2.9 trillion in reserves at the end of last year.

Looking ahead, the board of trustees projects Social Security will draw down these asset reserves by 2035. That doesn’t mean Social Security is “broke” in 15 years. At that time, according to the report, assets would be sufficient to pay 79 percent of monthly benefits. Currently about 64 million people receive monthly benefits; 54 million retirees, spouses and survivors from the OASI trust fund and 10 million individuals from the disability trust fund. Payroll taxes are collected to fund benefits. These taxes – FICA (Federal Insurance Contributions Act) – are withheld from workers’ paychecks. Employees pay 6.2 percent of their earnings with an employer’s match of 6.2 percent. The self-employed are responsible for the entire 12.4 percent.

Roughly 80 cents of every dollar paid in to Social Security goes to the OASI fund. In 2019, the earnings of approximately 178 million workers were taxed and paid into Social Security. This is a critical distinction that connects the current workforce with current beneficiaries. From one generation to the next, earnings of U.S. workers are taxed while they’re in the workforce. In turn, they count on benefits to be there for them when they’re retired, widowed or disabled. These hard-earned benefits forge the social contract that has become part of the social fabric of America. So, when there are proposals to lift the lid on taxable earnings or target higher-income workers, they’re proposing to unravel the threads of this tightly-knit social contract. It’s not a welfare program, it’s an earned benefit program. There are some proposals that would raise the payroll taxes for higher-income earners to 12.4 percent for all of their income. And yet, they wouldn’t be entitled to anything extra in return for paying extra taxes. That breaks the “earned benefit” agreement FDR struck when he enacted his New Deal with the American people. Perhaps more importantly, an extra tax on higher-income workers would not fix Social Security’s long-term insolvency issues. That’s the real challenge before us at the policymaking tables – adequately fund the Social Security program while maintaining our commitment to seniors and American workers on disability who depend on it. Shoring up Social Security in the long-term will require lawmakers to worry less about scoring short-term political points and more about doing what’s right for current and future generations of Americans.