Tax rates matter. They determine how much income an individual or business must pay to the government. For every dollar taken away by taxes, it is one less dollar an individual, family, or business has to save, spend, or invest. Tax rates also play a big role in how competitive a state economy is in relation to other states. Higher tax rates not only penalize hard working individuals, families, and businesses, but they also deter economic growth and make a state less competitive.

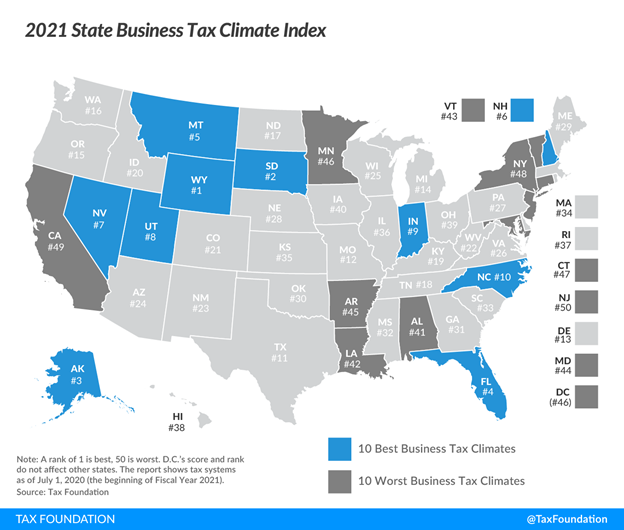

The Tax Foundation’s 2021 Business Tax Climate Index provides a measure of how state tax climates compare. Iowa ranks 40 out of 50, which is a slight improvement from last year when the state ranked 45th for worst business tax climate. Regionally, Iowa’s tax climate is worse than all neighboring states with the exception of Minnesota. South Dakota, a no income tax state, received the second-highest ranking in the country.

Source: Tax Foundation

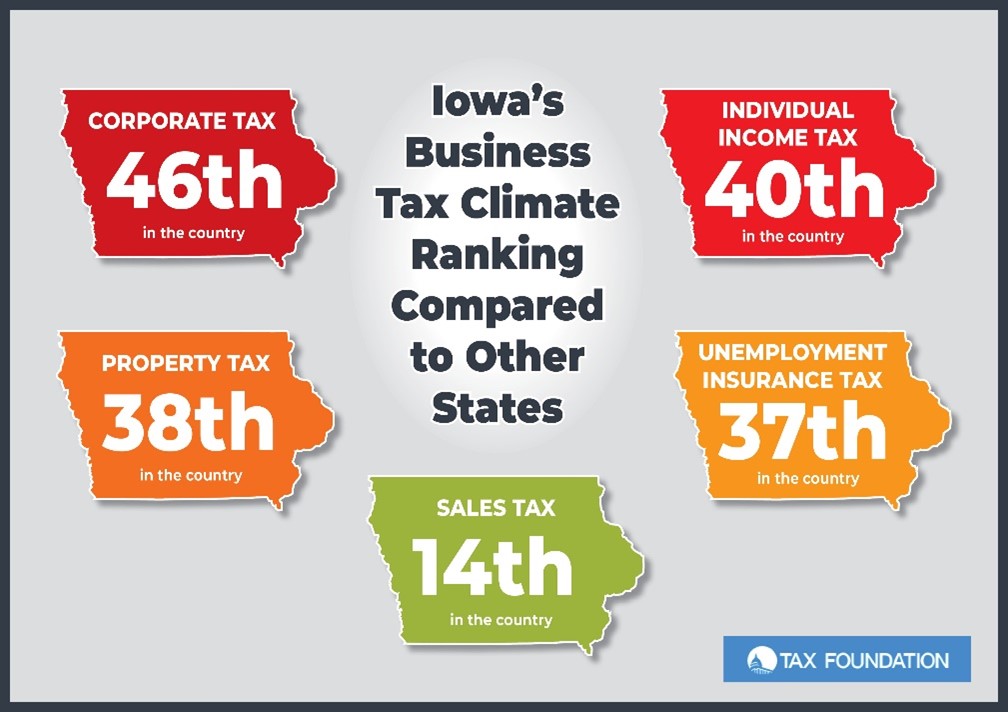

Iowa ranks high on every tax category except for the sales tax.

High tax rates remain a concern for both individuals and businesses in Iowa. However, Governor Kim Reynolds and Republicans in the legislature have made progress on recent tax reform. In 2018, the legislature passed a tax reform law that lowered both individual and corporate income tax rates and broadened the sales tax base. The 2018 tax reform law took a phased-in approach and it will take several years to fully implement.

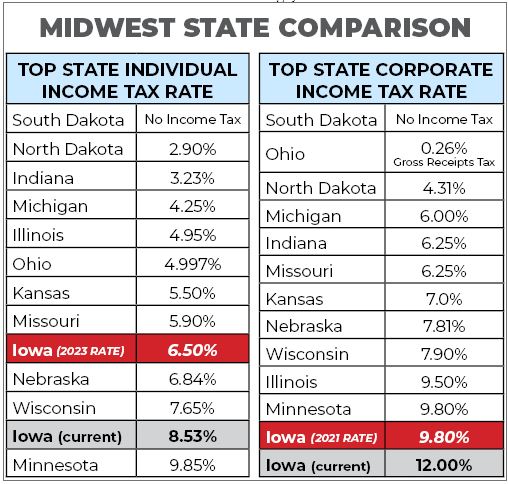

At 12 percent Iowa has the highest top corporate tax rate. In 2021, Iowa’s corporate tax rate is scheduled to fall from 12 percent to 9.8 percent. In 2023, if revenue triggers are met, Iowa’s top income tax rate is scheduled to fall from 8.53 percent to 6.5 percent. The Tax Foundation credits recent tax reforms by the legislature which helped improve Iowa’s ranking.

In terms of property tax relief, the legislature passed a law in 2019 that created more transparency and accountability within the local government budget process. This law requires local governments such as counties and cities (school districts were not included) to hold a public hearing if the proposed budget increases more than two percent above the previous year. It also requires a supermajority vote for the increase to be enacted. This two percent “soft cap” is meant to control the growth of property taxes.

Prior to the COVID-19 pandemic, Governor Kim Reynolds proposed the Invest in Iowa Act, which called for further tax reform. A main focus of the Invest in Iowa Act called for a 10 percent income tax reduction in 2021 with the goal of lowering the top rate to 5.5 percent by 2023. The income tax reductions would be financed in part with a one cent increase in the sales tax.

However, due to the COVID-19 pandemic, the Invest in Iowa Act was tabled. Recently Governor Reynolds stated that she may push for this proposal during the 2021 legislative session. The Governor understands that Iowa needs to become more economically competitive.

“I think we have an opportunity to just say to people on the East and West coasts, and honestly in Minnesota and Missouri, ““Hey, things are going well here, there’s a lot of opportunity, we have a great quality of life and all components of that really helped build that out,”” stated Governor Reynolds.

“The evidence shows that states with the best tax systems will be the most competitive at attracting new businesses and most effective at generating economic and employment growth,” wrote Jared Walczak and Janelle Cammenga, authors of the 2021 Business Tax Climate Index.

“It is important to remember that even in our global economy, states’ stiffest competition often comes from other states,” noted Walczak and Cammenga.

How can Iowa continue to lower tax rates and ensure that the state is competitive, and taxpayers keep more of their hard-earned income?

- Conservative budgeting: Any pro-growth tax reform must start with limiting spending. The COVID pandemic has created economic uncertainty. Iowa’s budget is in sound shape as result of following fiscal conservatism. In January, as the legislature reconvenes, legislators will need to continue to adhere to conservative revenue estimates and limit spending. Limiting spending is vital to achieving pro-growth tax rate reductions. Unless spending is addressed it will be difficult to cut tax rates.

- Lower individual and corporate tax rates: Legislators should continue to lower income tax rates. This includes either eliminating or controlling spending to ensure that the 2023 revenue triggers are met to lower the individual income tax rate. Iowa’s corporate tax rate should continue to be lowered even when it is reduced to 9.8 percent in 2021.

- Property tax reform: Policymakers should build on the 2019 property tax transparency and accountability law by requiring further clarity in the property tax process. Iowa should replicate Utah’s Truth-in-Taxation law by requiring direct taxpayer notification. This would require local governments to notify taxpayers directly of a proposed property tax increase. Taxpayer notification would provide clarity by bringing further transparency and allowing taxpayers to know how much their property tax bill will increase. Another reform option would be requiring voters to improve any local government budget increase. Both options would force local governments to justify additional spending.

These policy goals would greatly improve Iowa’s tax climate. The 2021 Business Tax Climate Index is another reminder that Iowa’s tax rates are too high. Iowa needs to follow the example of other states such as North Carolina, Indiana, and Utah and continue to lower tax rates.

Reducing tax rates will not only allow taxpayers to keep more of their hard-earned money, but it will also lead to economic growth and make Iowa a more competitive and attractive state.