Tax rates matter. This statement may seem obvious, but tax rates are a major factor in determining the economic well-being of a state. The Tax Foundation recently released the 2024 State Business Tax Climate Index, which measures the tax competitiveness of the individual states. As a result of Iowa’s recent tax reforms our standing within the Index is improving every year. Last year, Iowa ranked 38th overall and in the 2024 Index, Iowa is now ranked 33rd in the nation. This is remarkable because for several years Iowa ranked in the bottom ten for the worst business tax climate.

The Tax Foundation specifically pointed to Iowa’s recent tax reforms which lowered the top income tax rate from 8.53 percent to 6 percent. This also simplified and consolidated income tax brackets from nine to four. Further, Iowa eliminated the marriage penalty and simplified the corporate income tax brackets from three to two.

The Tax Foundation’s ranking only reflects recent tax reform changes that have been implemented. Income tax rates will continue to be lowered until the 3.9 percent flat rate is achieved in 2026. Starting in January 2024 the corporate income tax will fall from 8.4 percent to 7.1 percent. Eventually the corporate income tax rate will be lowered until it reaches a flat 5.5 percent. This is substantial because not too long-ago Iowa had a 12 percent corporate tax rate.

Once Iowa’s flat tax is completely phased in by 2026 it is estimated that Iowa will be ranked 15th overall. “With the full phase-in of the newly enacted reforms, Iowa would rank 15th overall, an improvement of 31 places. This would tie North Carolina for the largest improvement in the Index’s history,” notes Jared Walczak, Vice President of State Projects at the Tax Foundation.

With a 3.9 percent flat tax Iowa will not only have replaced the progressive income tax but reduced the top tax rate by almost 60 percent.

A warning area for Iowa is property taxes. Iowa is ranked in the bottom ten for the highest property taxes in the nation. This past legislative session the legislature passed a comprehensive property tax reform measure, which will start addressing the property tax burden. It is clear that more work is needed to address Iowa’s property tax dilemma.

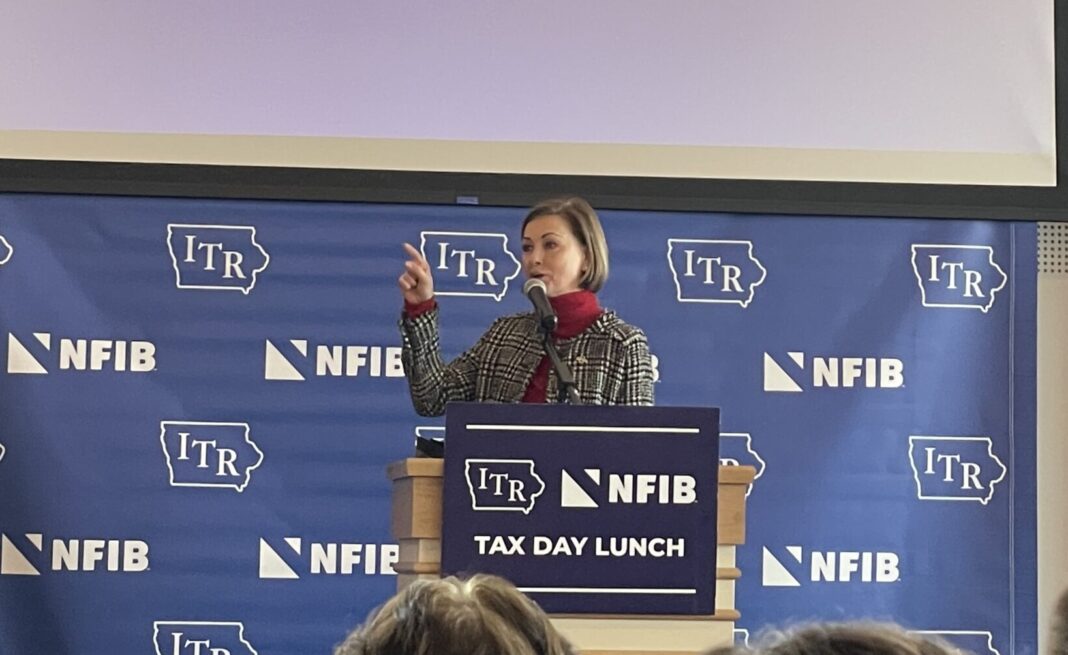

Nevertheless, Iowa is getting more national attention as a result of the pro-growth tax reforms being implemented by Governor Kim Reynolds and the legislature. Since 2018, Governor Reynolds and the legislature have placed a priority on not only lowering income tax rates but making the tax code more competitive. In 2022, Iowa led the nation in the state “flat tax revolution” by passing the most extensive tax reform measure in the nation.

Iowa once had some of the highest income tax rates in the nation. Now Iowa is the gold standard leader in state tax reform and none of this would be possible unless Governor Reynolds and the legislature were not committed to conservative budgeting. At the heart of a successful tax reform policy is spending restraint. Governor Reynolds and the legislature have made fiscal conservatism a priority.

As a result of prudent budgeting Iowa has had multiple rounds of budget surpluses, including a $1.8 billion surplus for fiscal year 2023. This surplus is $86.3 million higher than originally projected and future surpluses are projected for fiscal year 2024 at $2.1 billion and $2.9 billion for fiscal year 2025. Iowa’s reserve funds (Cash Reserve and Economic Emergency) are also full at $961.9 million.

The budget surpluses have also resulted in the Taxpayer Relief Fund increasing in size. The Taxpayer Relief Fund currently has a $2.7 billion balance, which is expected to grow to $3.6 billion by fiscal year 2024 and grow even larger to $3.8 billion by fiscal year 2025.

Clearly, Iowa is still collecting too much from taxpayers and this is why Governor Reynolds, and the legislature are placing a priority on further income tax reform in the upcoming 2024 legislative session.

Governor Reynolds has stated that her goal is to not only to have the lowest flat tax in the nation, but also place the income tax on a path toward elimination. During the last legislative session Senator Dan Dawson, chair of the Ways & Means Committee, introduced a tax reform measure that would achieve this goal. Senator Dawson’s measure would accelerate rate reductions, while continuing to lower the income tax rate until it reached a flat 2.5 percent. Senator Dawson’s measure would then use the Taxpayer Relief Fund to gradually eliminate the income tax.

Next year Iowa is on track to continue its historic tax reform efforts. Accelerating existing tax rate reductions and working toward a lower flat income tax rate of 2.4 percent or lower are all achievable. This also includes the possibility of placing the income tax on a path toward elimination.

Iowa is a national leader in pro-growth and prudent tax reforms. Fiscal conservatism is working in Iowa. Spending restraint and lower tax rates are not only creating a stronger economy but unleashing greater economic liberty.